Decentralized finance applications is as yet considered for all intents and purposes new in the crypto industry. There are various DeFi applications that have been created since DeFi made its presentation. A prominent platform amongst the rest is the Yield app, which is also your focus today.

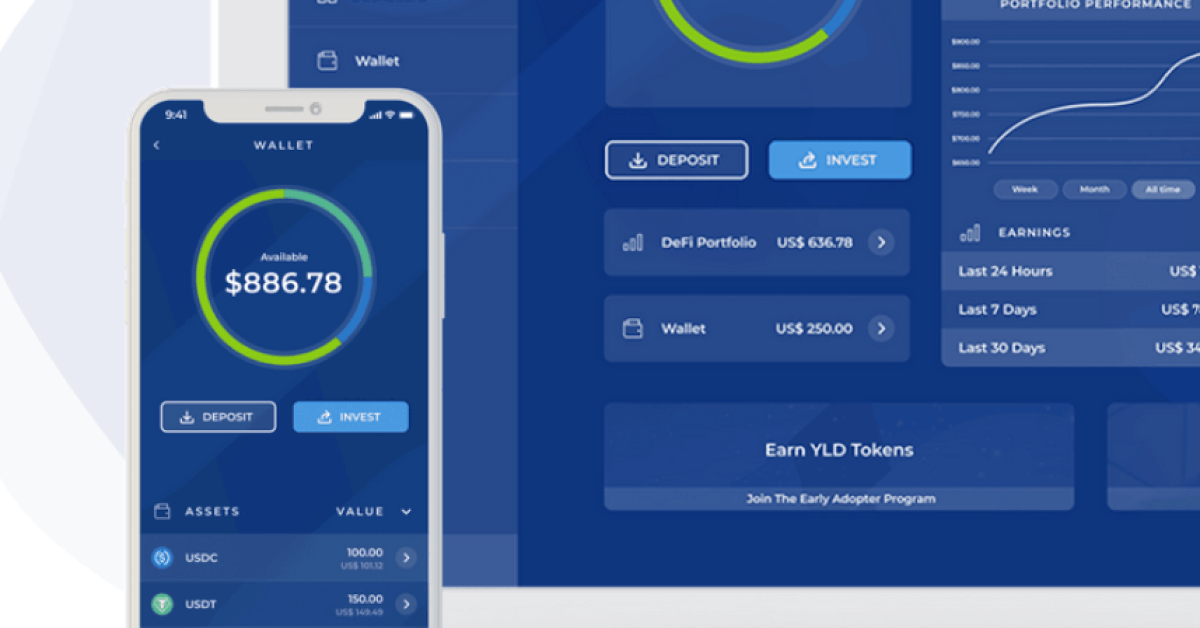

Yield.app offers an exceptional yield store account combined with safe guardianship of client assets. The Yield.app dashboard is natural where the clients can deal with every one of their shares in a single record. Regardless of whether you are new to DeFi, you are a conventional financial backer, or basically hoping to get to elective pay-producing speculations, Yield.app is for you.

About Yield.app

This is a platform that carries DeFi to essentially anybody with a phone. Yield offers you a platform intended to give the most straightforward approach to put resources into DeFi utilizing crypto in regards to your monetary or mechanical degree of skill. Its straightforward app and online platform empower clients around the globe to acquire exceptional yields from DeFi items without experiencing a protracted, complex, and frequently expensive learning measure.

Yield app is one out of the numerous DeFi platforms and its central goal is to give a creative stage that spans customary and decentralized accounts. They intend to do that by offering exceptional yield venture finances that don’t depend on unsteady public monetary forms or unadulterated theory.

What separates it from basically every other DeFi loaning app is that not exclusively is loaning boosted, as usual, however so too is borrowing. No longer will you need to effectively deal with your advance to term yet procure nothing for your difficulty. This aids not just the borrowers and borrowers of non-stable resources like ETH yet additionally, and maybe particularly, the borrowers of stable resources like DAI and USDC.

The Yield app has a current supply of 33,320,346 with 0 in circulation. The most recent known price of the Yield.app was $ 0.1492988 and dropped -4.40 in the last 24 hours. It is currently traded on 2 active markets with $ 868,358.60 traded over the past 24 hours. To know more about yield.app’s services you can visit: https://www.yield.app/.

The Differences Between Yield.app And Traditional Bank

Yield farming has demonstrated to be a lucrative method to get some income latently. Yearn Finance is living verification. Welcoming a profit from tokens being marked or held in a biological system so clients can contribute is a progressive thought that is starting to discover its way into the conventional financial model. A bank basically does likewise with your well-deserved dollars when they are saved into reserve funds or financial records. Cryptographic money simply adds another truly necessary layer of straightforwardness. Yield.app is expanding on this idea and has made a biological system that hopes to bring conventional banking and decentralized money together.

What makes the ecosystem so extraordinary is that clients don’t need to essentially “lock” their tokens in the environment to procure APY. To acquire an interest in their tokens, clients should essentially hold YLD in their wallets.

The Perks Of Yield.app

As indicated by the Yield.app group, Yield is overseen by a group of specialists in capital business sectors, fintech, network safety, and blockchain innovation. Resources are secured by the business driving caretaker BitGo. It is intensely controlled, working under banking, protections, and resources the executives permit to guarantee client security. Furthermore, the YLD Insurance Fund offers further assurance to the stage’s evaluated security foundation.

The disadvantage of liquidity provision is negligible. Regardless of the characteristic orderly danger of shrewd agreement disappointment, giving liquidity is a sound method of acquiring automated revenue with crypto instead of exchanging it.

Are There Any Downsides To It?

As promising as it may seem, there are still some underlying risks within the app such as the followings:

- Contract Risks: This is concerning the instruments utilized in DeFi, for example, loaning stages and decentralized trades which are administered by keen agreements. These agreements can’t be halted whenever it is delivered on the blockchain so, on the off chance that you are lamentably utilizing an unaudited contract, odds are you might be presented to expected blunders.

- Human Error: Most of DeFi’s normal dangers are because of human mistakes themselves. There are wide assortments of instruments out there that you can abuse effectively, which can prompt a colossal misfortune.

- Extortion: Promises of generally safe exceptional yield speculations can be enticing consequently it permits others to make malignant devices to draw clueless clients and imperil their assets.

- System Risks: Liquidity mining is the utilization of crypto-financial motivating force systems to cause clients to act in a specific method to profit the environment. Most techniques join these components, some of which may get excessively perplexing, which may bring about capricious results.

- Liquidity Risks: Some DeFi instruments that are accessible expect investors to bolt their resources for a particular period. This may bring about a circumstance wherein you’re stuck and can’t leave the entirety of your monetary positions right away.

Conclusion

Yield.app re-invents banking through Decentralized Finance (DeFi). With this, you can get to the best speculation openings, independent of your monetary or specialized information. They endeavor hard to demonstrate the capability of DeFi and make it available to the entire world.

The drawn-out objective for Yield is to make a fulfilling and impartial advanced financial framework that anybody around the planet can utilize to acquire interest on any cash. The group likewise plans to dispatch a physical crypto charge card that will permit clients to spend their crypto as though it was fiat.

Should the estimation of your resource contributions drop fundamentally, Yield.app professes to support against rises or falls in their incentive with related positions at equivalent incentive through authorized crypto fates trade contracts. All things considered, you ought to consistently do your own exploration with respect to DeFi, blockchain and crypto projects.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.