December is not only a good time to start summing up 2020 (and what a year it has been).It is also an opportunity to start looking ahead at 2021. While the effects of the pandemic will still be dominant in our day-to-day life, a light can be seen at the end of the tunnel. Just like COVID-19 had a massive effect on how humanity handles itself financially, the ability to control it will have the same reverse effect andwill probably assist greatly in getting life back on track.

It’s not only about an upcoming vaccine, but also about economic dynamics which are starting to get back on track, or so it seems. In other words, markets around the world have passed the stagnation phase and are now returning more or less to their normal behaviors. Having said that, here are three investment venues that are worth taking a look at toward the new fiscal year.

Real estate

Source: https://unsplash.com/photos/F1MlxlEpaOk

Some markets were less affected by the virus than others, and there’s a logic behind it. The real estate market, for example, is one that’s based heavily on supply and demand. Even a pandemic can’t really change people’s need for housing, that’s why this market overall displayed business as usual. Since projects kept being built and people kept renting or buying homes, real estate prices did not drop –just like analysts had expected.

It would probably be a good idea to invest in real estate next year. The slowdown felt in March, when COVID-19 entered our lives, was not substantial and the market was on its feet pretty fast. While other sectors are still ‘licking their wounds’, real estate trends are at full speed and have been that way for the past few months. This investment is certainly worth considering, especially for longer terms.

Cryptocurrencies

Source: https://unsplash.com/photos/HqoBzN0ICMQ

A quick look at how cryptocurrencies in general did in 2020 shows they were merely affected by the Coronavirus. Quite the opposite, actually. Bitcoin, for example, has reached new all-time highs. This probably has to do with investors shying away from fiat currencies which are dependent on countries’ financial situations.

However, before investing in crypto coins, one must be aware of the dangers. The Cryptoscam has been common almost ever since cryptocurrencies became a popular investment venue. If this has already happened to you, know that you’re not alone. These scams can come in many forms, mainly due to the fact that cryptocurrencies, in their nature, allow a high level of anonymity.

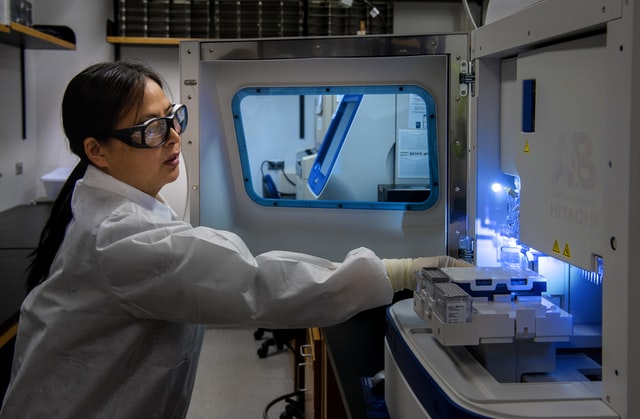

Pharmaceutical stocks

Source: https://unsplash.com/photos/-V-nbUmDfzM

This one is pretty self-explanatory. Companies involved in medical solutions, equipment, research and med-tech enjoyed a soar in their stock values, especially if they have anything to do with finding a cure or a vaccine to COVID-19. Even medical companies with indirect linkage to the virus enjoyed nice profits from it in 2020.

One good example are companies manufacturing respiratory machines. There was great demand for them all over the world once the virus’ symptoms became clear, and these companies of course had only to gain from that. Another example would be companies producing and distributing sanitary products such as gloves and masks – for obvious reasons.

Bottom line

These are three markets that are worth taking a closer look at when planning your investment portfolio for 2021. With the assumption that COVID-19 will stick around, the sectors less affected by it in 2020 will probably continue to be safer investments. This is no guarantee, though, and we recommend first and foremost to feel the financial pulse constantly.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.