A medical emergency is usually one of the top reasons why many people apply for a personal loan. Life can catch you off-guard at any moment if you are not prepared for emergencies and can lead to financial hardships. If you do not have the required financial backup, you tend to seek help from your family and friends for financial assistance. To deal with such an emergency, you can opt for a personal loan. Being an unsecured type, you are not required to pledge any of your valuable assets as collateral. A personal loan ensures that you get funds just when you need them. You do not have to think much about expensive medical treatments and focus solely on yourself or your loved one’s health.

The best thing about getting a personal loan is its end-use; you can use the loan for all kinds of financial requirements. A personal loan will allow you to sail through the testing times without any stress. You can apply for Bajaj Finserv personal loan online, and get an unsecured personal loan for a medical emergency. At Finserv MARKETS, the process of personal loan for a medical emergency is simple and easy. Bajaj Finance Personal Loan Interest Rate starts from as low as 9.85% per annum with flexible repayment options on personal loans.

Features and Benefits

The features for Bajaj Finserv Personal Loan are stated below.

- High Loan Amount

You can apply for a personal loan for medical emergencies with a loan amount anywhere between Rs. 25 Lakhs to Rs. 40 Lakhs. This loan funds will help provide for all the medical expenses for medication, treatment, and hospitalization in case of an accident or critical illness.

- Flexible repayment tenure

An instant personal loan has a flexible repayment tenure ranging from 1 year to 5 years. The flexible tenure makes it an ideal option for financing medical emergencies as the loan can be repaid conveniently over the long tenure. So, you can conveniently repay the amount in EMIs towards your loan and focus solely on your loved one’s health.

- Quick Loan Approval

During a medical emergency, you have no time to wait for the long loan process and loan approval; this is where the personal loan works best for you. When you apply for a personal loan, you need to submit the documents and the loan gets approved at the earliest.

- Instant Loan Disbursal

When you submit all the required documents for a personal loan, these documents are then going through a verification process. Once the submitted documents are verified and suitable to move ahead, the loan gets disbursed within 24 hours, and you will have the funds in your account.

Eligibility Criteria

When applying for a personal loan, you need to check with the basic loan eligibility criteria. The criterion is a list of parameters that determines your creditworthiness. Below mentioned are the eligibility criteria for Bajaj Finserv Personal Loan:

- The applicant needs to be an Indian citizen residing in the country

- To be eligible for a personal loan, your credit score should be 750 or above

- The applicant must have a steady source of income to be eligible for a personal loan

- Individuals between the ages of 25 and 57 years are eligible for the loan

Documents Required

- Identity Proof: PAN Card/Voter ID/Aadhaar Card/Passport/Driving License

- Proof of Residence: Aadhaar Card/Passport/Driving License/Electricity bill

- Proof of Income: Bank statement or salary slips of the previous 3 months

- Passport size photographs

- For NRI (Non-Resident Indian)

- The following are the documents required for NRIs:

- Passport and Visa copy

- Bank statements of the last 6 months

- Identity Proof

- Address Proof

- Salary slips

- Passport-size photographs

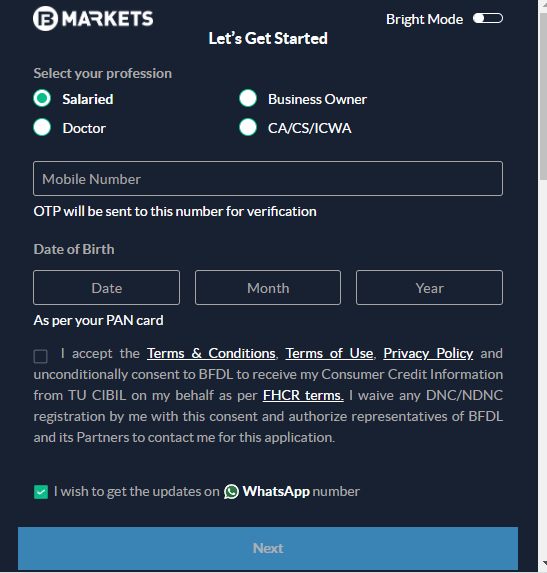

Personal Loan Application

Here’s a step by step guide to apply for a Bajaj Finserv Personal Loan online:

Step 1: Enter your personal, financial, and employment details on the loan application form

Step 2: Select the loan amount you require and the loan tenor, to get instant online approval.

Step 3: Submit the set documents required for verification process

Step 4: Once your loan is approved, the loan funds will be disbursed in your bank account within 24 hours.

Step 5: That’s it.

Getting a personal loan is the best way to cover any medical emergency. Do not worry about the interest rate on a personal loan and apply for the loan when in need. Personal loans have essential eligibility criteria and quick application procedure. Hence, availing a personal loan will help prevent a financial breakdown in times of emergency and get immediate access to funds.