Savings play an important role in our life, especially for funding sudden or emergency expenses. You can either keep your savings in your home stashed away in a box or a cupboard or deposit it in a bank. While the former comes with concerns related to keeping the money safe, the latter is simple and convenient.

When you open a savings account, it not only allows you to keep your money safe in a bank but also provides you with interest income on the amount deposited in it. And the best part is you can withdraw your funds anytime from anywhere you need them. The savings account comes with several other benefits like an ATM card.

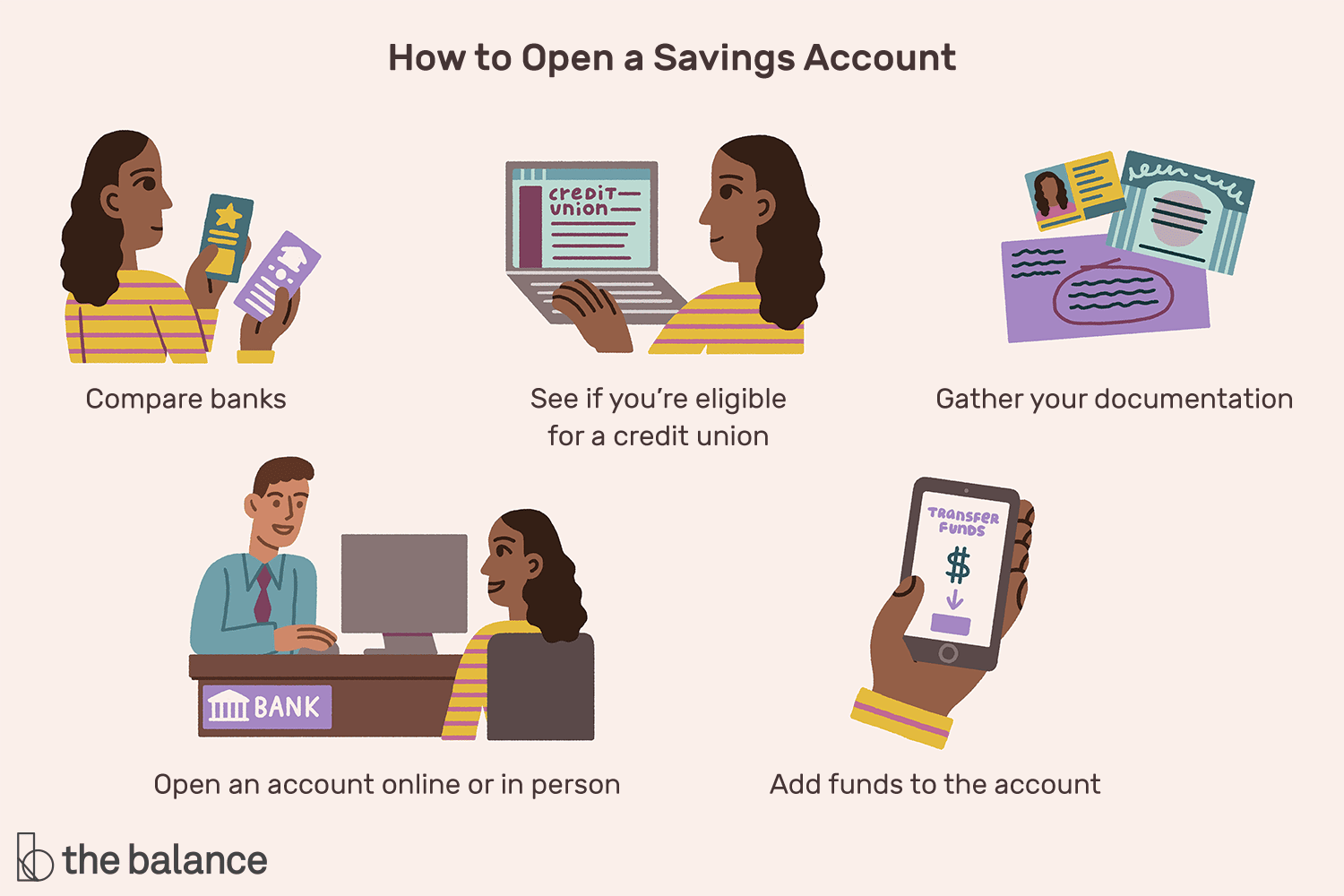

You can either open a savings account by personally visiting a bank or apply online. The whole process of new account opening is very simple. Not only, can you open an account online, but also operate it online using your mobile, laptop or personal computer.

How Does a Savings Account Help?

While you can store a limited amount of cash in your home, bigger amounts should be parked in a bank account, A savings account is an excellent mode of keeping your money safe without worrying about its theft or loss, or damage.

You can also use this account to:

- Make and receive payments

- Pay your utility and other bills

- Make investments, pay EMIs

- Make fund transfers through NEFT, RTGS and IMPs

- Withdraw cash from ATMs

- Use internet banking facility to do online shopping

Saving account holders can also avail of attractive loan schemes at low-interest rates from the same bank.

Who Can Open a Savings Account and What are the Requirements?

- If you are an Indian National, you are eligible to open a savings account- individually or jointly with another Indian National. The requirements include filling out an application form and the submission of the necessary documents for the completion of the KYC or (Know Your Customer) procedure.

- A Hindu Undivided Family can also open a Savings account.

- Foreign Nationals living in India and meeting the Government of India’s requirements.

Steps to Open a Savings Bank Account

- The first step is to visit the concerned bank’s nearest branch and take a new account opening form.

- Check the requirements related to the initial deposit and the minimum monthly deposit in the account. Also, check whether you will be given a debit card or an ATM card related to the account. Another thing you should enquire about is the number of withdrawals allowed from the account in a month.

- Fill in the form (you will also need to paste your photograph) and provide details relating to your name, address, signature, and various other details like your PAN number. You will also need to provide documents to support your identity and address and proof of income.

- Make an initial deposit as mandated by the bank.

- You can also submit a form for enabling internet banking and phone banking

- The bank will process the application and verify the details with the supporting documents before issuing you a passbook and a chequebook.

You can also apply online for a savings bank account by visiting the concerned bank’s website and filling the form. You will have to upload copies of the supporting documents and may be asked to fulfil the KYC requirements over the phone or a video call.

While the process of opening a savings bank account is simple, you need to be aware of the terms and conditions associated with is opening. This will help you find out about the services available and the fees payable on certain transactions.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.