Given the rising popularity of index trading, it’s no surprise that more and more people are racing to dabble in trading. Index trading uses indices as an investment vehicle to profit from market changes.

Safer than trading stocks traditionally, more people are diving into the world of trading indices. As these investments become more common, it’s a good idea to familiarize yourself with the best practices and strategies of index trading before diving in headfirst. Read on for three strategies you need to know to trade indices.

1. The 3 Days Drive

The 3 Days Drive is one approach to effectively trade indices during a market pullback. A quick point on shorting is that you can initiate a short sale at any time, but are required to return shares to your brokerage within three days. The idea behind 3-day trades is that stocks may be moving quickly in one direction, but after three days you might have more information about how far they can go before they reverse their trajectory.

Initiating a short position at a high point and buying them back once they’ve dropped to a low point makes sense from an investor’s perspective. This way, you lock in as much profit as possible while limiting your risk exposure. If you’re following the 3 Days Drive strategy, keep in mind that if you hold onto those shares for less than three days after purchasing them, your brokerage will likely charge a fee for selling too soon.

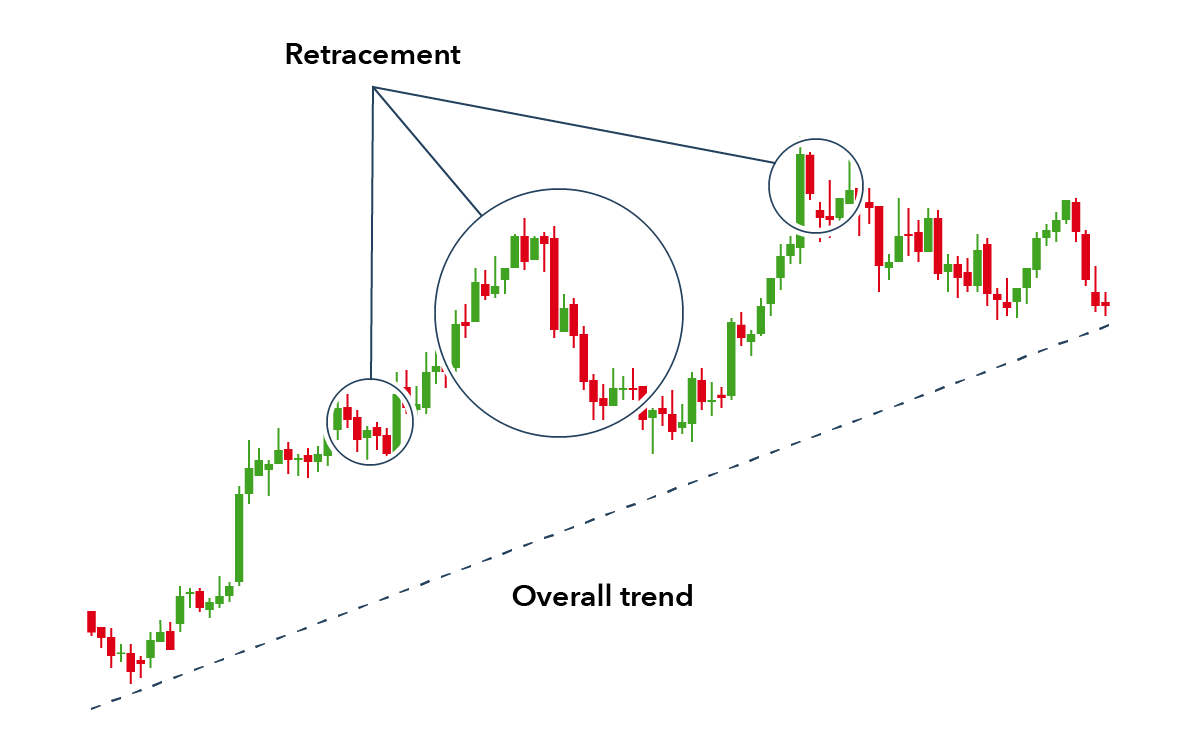

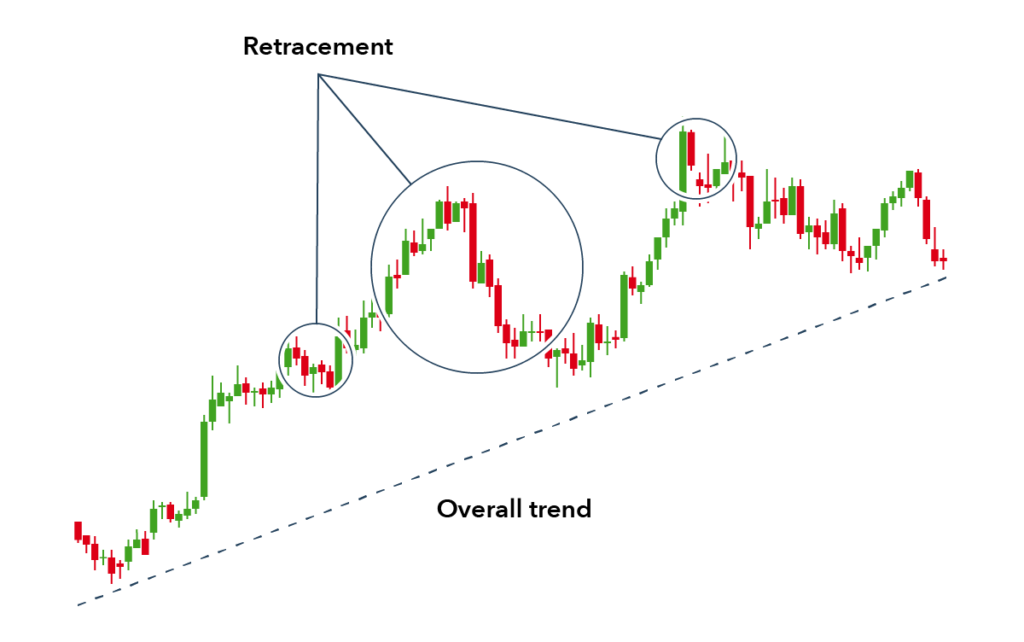

2. Buy a Stock Index on Dips

Many investors are more interested in taking advantage of rising prices than falling ones. However, according to companies like Capital.com, you can make money trading indices on dips as well by trading index futures. Here’s how it works: When you buy an S&P 500 future contract on a dip, you agree to buy 500 shares of Standard & Poor’s 500 stock index at a set price.

If prices fall below that point by expiration, you’ll be obligated to buy shares at that discounted price. If prices rise above that level prior to expiration, you get to sell your contract at a premium, profiting from rising prices for not much risk or effort beyond establishing your position and paying some small brokerage fees.

3. Pay Attention to News-Based Trading Events

Market-moving news and events can quickly and dramatically affect indexes and stocks. As a result, there is often a temporary dip in an index after an event occurs—and savvy traders can use these conditions to their advantage. For example, if you’re bullish on technology companies, it’s probably a good idea to put some money into an ETF that tracks that sector.

If something big happens to technology stocks (i.e., Bill Gates announces he’s retiring from Microsoft), then investors may sell off those companies’ indices for a while following news events like this. After some time passes, many investors will realize their mistake and reverse course by purchasing shares of technology companies once again.

In the stock market, there are many different kinds of trading strategies you can use to try and gain an edge up. As you learn more about index trading, keep these three strategies in mind.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.