The income statement is basically a core financial statement of the company that shows the profit and loss over the year or period. Also, it’s known as profit and loss statement too. Usually, the income statement is prepared at the end of the financial year, but it can depend or can be made at the month’s end or quarter. Most companies go with this option in order to know the exact amount of their net income and loss. Not just that it can be prepared when the project ends.

Income statement and what to know about it

There are three statements such as balance sheet, the cash flow stamen, and it also includes income statement. These three statements are used in accounting as well as corporate finance, and it includes finance modeling. The statement shows the company’s cost, gross profit, revenue, selling, and other expenses, income, and administrative expenses. It includes tax paid and net profit too.

The income statement is divided that follows the operation of the company logically and time period. The most used one is the monthly division, usually for reporting internal. However, some of the companies use thirteen-period cycle too. The stamen is ideal for a financial model to begin. It includes mostly all information’s regarding balance sheet and cash flows statement,

What are the format and types?

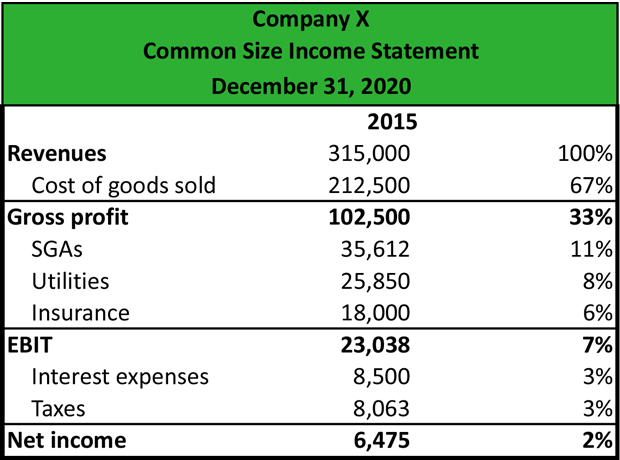

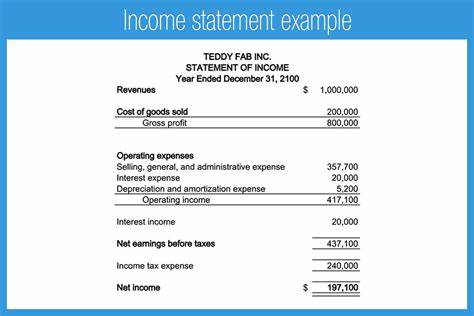

The income statement is in report form. The header starts with identifying the company, statement, and period to which the income statement is related. It includes currency reporting and rounds off level.

The next is the revenue and cost of the sold goods as well as gross profit calculation. Further going down in income statement, there are details regarding the operating expenses, taxes, and non-operating expenses. Well, the statement ends with a per-share earning presentation.

There are two types that can find in income statement i.e., single-step statement and multi-step statement. In a single-step statement, the income and expense are shown in one step without classifying anything else. However, this type contains extremely limited information which is not really useful

The multi-step statement is also a report regarding financial which contains the operation of the company related their cost of goods, sales, and expenses. This format contains more information that financiers need.

The need for income statement:

The main focus engine preparing the income statement is to get the net profit as well as a net loss to that particular time. It can be different on the time period is chosen, as it can be yearly, monthly, quarter, half-year, and month. But apart from this, there are more benefits to preparing the income statement.

It includes determining the gross profit, which Is much simple and easier with this statement. Apart from this, the operating expense trends and amounts can be measured. It includes distribution, selling, administration, etc. with the help of income statement, the information related to finance can be gathered together. It helps in calculations and knowing more details which save time.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.