Well, it is also known as COGS, which is a managerial calculation. It is used in measuring the cost which is directly incurred in product producing that were sold on that period. However, in different words, Cost of goods sold is a month which is spent by the company on things like material, labour, including the manufacturing to the product purchased that were sold during the year.

Cost of Goods Sold: Formula with Example

The primary purpose behind using the cost of goods sold is to get the exact cost which was used in producing the product and sold to the customers on that year. Also, it’s important to understand that indirect cost or to make the product that was not sold on that year is not added in the final numbers. Those costs which are related to direct and sold by the merchandise on the following year is included.

Also, the formula of COGS is crucial, especially for management. It helps in understanding about analysing and controlling the cost of purchasing as well as payroll. Apart from this, investors and creditors get the idea about revenue percentage that can be available for covering the operating expenses. They can use the formula for calculating the business’s gross margin.

How to Calculate?

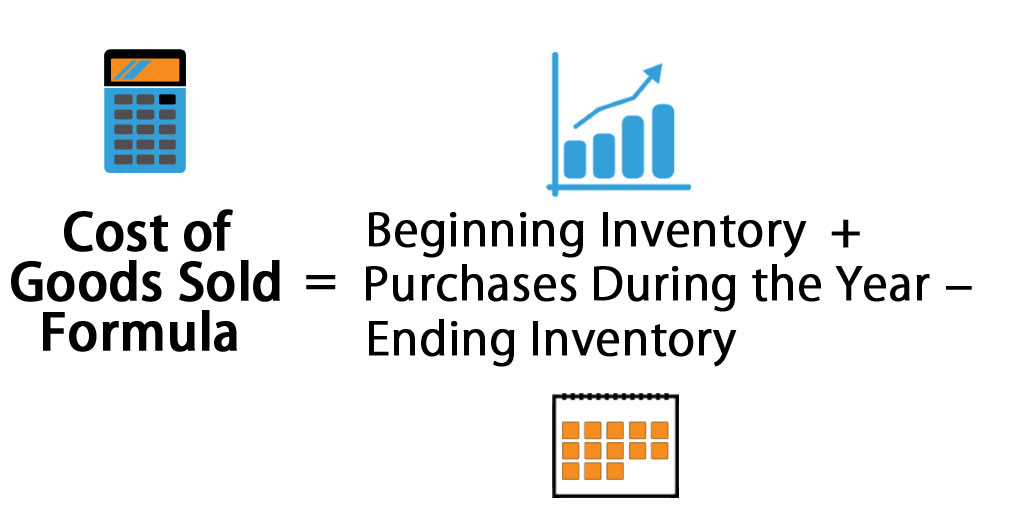

The calculation of Cost of goods sold is simple, for that addition of purchases for the beginning inventory and subtract the inventory in the ending period. Here is the formula,

Cost of goods sold = Beginning inventory + Purchase – Ending inventory

To start with the beginning inventory, its important as you are calculating the merchandise cost during the period and how much it was sold. To understand the calculation, here is an example that can help.

Example: The sports company sell gears during the holiday season. The end accounting was beginning inventory $100,00, ending inventory $ 35,000 and new purchase $ 450,000. What will be the cost of goods that were sold by the company?

Well, the calculation will be

$515,000 = $ 100,000 + $ 450,000 – $35,000

The merchandise costing that the company sold is $515,000 during the year where the product of $35,000 is still left.

Why is the Cost of Goods Sold Important?

To calculate the gross profit, Cost of goods sold is important for the company. Well, the gross profit is the measures which help the company to understand how efficiency the company is balancing the labour and supplies during the production process, including the profits that are earned. Cost of good sold is basically the cost of doing business. So, it also records the expense on the business income statement.

With the help of COGS, the investors, analyst and managers can get the estimate of the company and get the bottom line too. It also means that if the numbers in Cost of goods sold increases, it would decrease the net income of the company as well.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.