The year over year is a calculation which is being used for comparing the statistics of a single year with the previous year. The period is often calculated in either quarter or monthly basis. The year-over-year is used for calculating the growth thorough making a calculation of the previous twelve months. The Year over Year is one of the best strategies which can be used for enhancing growth. The first reason is the impact of season.

For instance, In case your business had a revenue of twenty percent the previous month. And when you check the revenue of the same month from the previous, you will be able to calculate the difference of revenue of both the years which will help you to detect that whether your revenue rises every year during this seasons. As per the rulebook, if your business is witnessing a rise of thirty five percent this month, then your business is doing no good.

What is Year-Over-Year ?

Furthermore the year over year likewise help in distinguishing the long haul changes. State a business is developing at a pleasant, relentless 2 percent a month. Be that as it may, on the off chance that it grew 3 percent a month a year ago, it will be down when analyzed year-over-year. Consequently, ensure you check what correlations a budgetary report is utilizing. Are the creators contrasting the information with the past entire year, for example, a year of aggregated income, or to a measurement’s an incentive as of the last time of the quarter, month, week, or day? Additionally, verify whether they are utilizing the schedule year or monetary year.

In case you’re pondering utilizing the YOY measurement, the accompanying depiction of the advantages and disadvantages can enable you to apply the metric all the more successfully. The greatest preferred position of year-over-year correlations is that they consequently invalidate the impact of regularity. For instance, retail measurements rise every November and December on account of the Christmas shopping season. It’s the most basic time as the season represents right around 20 percent of retail deals. Another preferred position is that the measurement is expressed in rate terms, making it simple to look at changed estimated organizations when doing industry, contender or friend organization investigation.

How to Calculate the Year-Over-Year Growth Rate?

Year-over-year investigation helps smooth out any unpredictability in the month-to-month numbers. For instance, speculators ought to have utilized a year-over-year correlation. A couple of issues can emerge with the YOY count, particularly if an organization encounters a time of negative development. The subsequent development rate won’t bode well. Additionally, similarly as with numerous different business measurements, the YOY measurement gives considerably more data when determined for a couple of timespans to uncover inclines, and doesn’t generally clarify a sufficient organization’s development story except if utilized alongside different measurements.

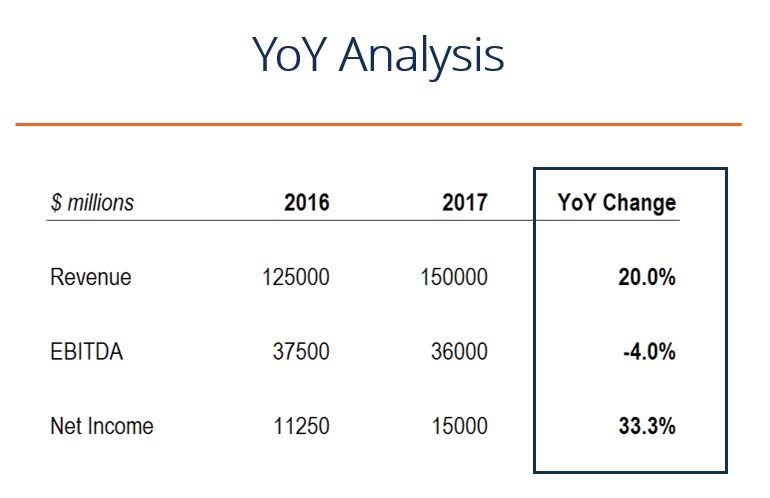

Examples of YOY Calculate Growth Rate?

In the event that you depend just on the YOY metric, determined with entire year esteems, you may likewise miss issues, for example, unusually low development in one month, which gets smoothed out if utilizing an entire year number for the figuring.

Most business news reports month to month patterns. You normally need to search out the year-over-year number yourself, however you can discover the equation contributions on an organization’s fiscal reports and effectively compute the measurement with a standard adding machine.

Deciding your year-over-year development is genuinely straightforward. You should simply subtract your present year income by a year age’s profit, at that point partition by a year ago’s profit. At that point, you increase the subsequent figure by 100, which furnishes you with a rate figure.

Normally, entrepreneurs use year-over-year development to contrast their income from one period with another, however realize that you can utilize the year-to-year development recipe to look at practically any figure. Additionally, you can do the year-over-year development equation to ascertain your presentation over a year, month, or quarter. Most government insights are month-to-month or quarter-to-quarter. You’ll have to figure the year-over-year numbers yourself to get the full picture. Here are three driving financial markers where it’s critical to do year-over-year computations:

- Sturdy Goods: The Commerce Department reports this measurement month-to-month. Be that as it may, YOY estimations cautioned of the Great Recession as ahead of schedule as October 2006.

- Assembling Jobs: America had been losing assembling positions on a month to month reason for quite a long time. Be that as it may, when employments began declining YOY in 2007, it was an indication of the pending subsidence.

- Total national output: It says how quick the economy developed in the latest quarter. The Bureau of Economic Analysis annualizes the GDP development rate. It reports how much the economy would create for the whole year in the event that it kept developing at a similar rate. The BEA does that so it’s simpler for you to complete a YOY correlation with earlier long periods of GDP development.

Each entrepreneur needs to know how their business is getting along after some time. Some may look to month to month benefit and misfortune articulations; others quarterly explanations. To truly perceive how your business is getting along, couple of measurements beat year-over-year development as a reliable benchmark to follow your organization’s advancement.

Pros and Cons of YOY:

Try not to misunderstand us—different computations are extraordinary for following your organization’s wellbeing and advancement, as well. Year-over-year development projection, in any case, gives you a top-level take a gander at whether your organization’s beating a year ago’s exhibition. This helps make regular business vacillations look less critical, and gives you expansive experiences into whether your transient objectives are prompting long haul achievement.

Conclusion:

Year-over-year development is a basic measurement to ascertain, which makes it an incredible apparatus to have in your stockpile as the year attracts to a nearby. You’ll have the option to take a gander at the master plan as a basic rate point. Along these lines, you can know initially in the event that you had a decent budgetary year and whether you’re going into the following year solid, Plus, on the off chance that you need to approach banks for a private company credit, They’ll need to see your year-over-year development before giving you the thumbs up for financing.

There are two noteworthy reasons for what reason you’d need to know your organization’s year-over-year development: to all the more likely comprehend your business at a top dimension and to give would-be moneylenders a feeling of your organization’s general wellbeing. Year-over-year development shows to moneylenders that your organization’s in great budgetary well being generally, nearly as a simple portrayal of whether you’re probably going to have proceeded with progress.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.