Budget 2020 proposed an alternate income tax system, starting from 1 April 2020. See whether or not you’re going to gain.

Many taxpayers planned to expand income tax deductions by budget 2020, while others wished to increase exemptions and deductions. Everyone, of course, wants to improve the tax system and reduce the income tax. There have been several dreams dashed by Budget 2020. Although it eventually broadened income tax slabs and the tax rates, it made it clear that the most allowances and benefits that people who vote for the current system had to consider.

Removing tax-exempts and deductions would render accounting less tiresome but willing tax planers would undoubtedly pay more tax under the current system, which maximized their deductions. The budget has deliberately sought to give people more revenue by eliminating spending opportunities.

Four out of five citizens are expected to move under the current tax structure by the Finance Minister. It analyzed the 57.8 million taxpayers’ income and investment data and found, according to the new system, that 69 percent will save on tax. An extra 20 percent will choose to move to avoid problems and paperwork involved in tax planning.

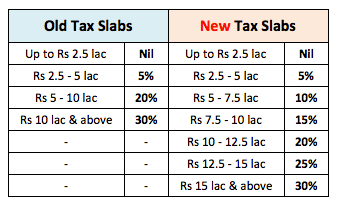

New Tax Slabs & Rates

| Annual Income | Will be Taxed at |

| Up to Rs. 2.5 Lakh | Nil |

| Rs. 2.5 lakh to Rs. 5 Lakh | 5% |

| Rs. 5 Lakh to Rs. 7.5 Lakh | 10% |

| Rs. 7.5 Lakh to Rs. 10 Lakh | 15% |

| Rs. 10 Lakh to Rs. 12.5 Lakh | 20% |

| Rs. 12. 5 Lakh to Rs. 15 Lakh | 25% |

| Above Rs. 15 Lakh | 30% |

Will you benefit?

For the typical Indian, the tax was already not that easy. The current tax structure has just contributed to the confusion of three additional tax burdens. Taxpayers like to know if the current system for taxes is more favorable. Numerous websites have calculators that enable people to work this out. To estimate the tax liability under the new tax panels, the income tax department itself launched an e-calculator. In both the old and new tax systems, it compares taxes.

You don’t have to make a detailed calculation to know that. Yes, the answer is quite simple. Anyone that seeks more than Rs 2.5 lakh of one year’s tax exemptions and deductions do not benefit from the new system. The standard Rs 50,000 deduction, for which no investment is required, is included in this Rs 2.5 lakh limit.

The new income tax structure may include non-salary taxpayers (including consultants) not qualified under Chapter VI-A for host exemptions and deductions, and even senior citizens not entitled to a regular payment of Rs. 50, 000 who are not retirement pensions.

Seniors, though, receive a substantial portion of their interest income and are excluded from interest taxes by Rs. 50,000 under current Section 80TTB. For those who work overseas, there are improvements. “Indians not residing in India and not taxpayers in any other nation will now be called taxpayers in India, and therefore taxable on global revenue in India.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.