The Government announced in the 2015-16 May budget the implementation in the insurance and pension sectors of universal social security schemes for all Indians, especially the poor and the vulnerable. In June 2015, the Government launched Atal Pension Yojana (APY). The APY will focus on all non-organized citizen members of the NPS administered by the Pension Fund Regulatory and Development Authority (PFRDA).

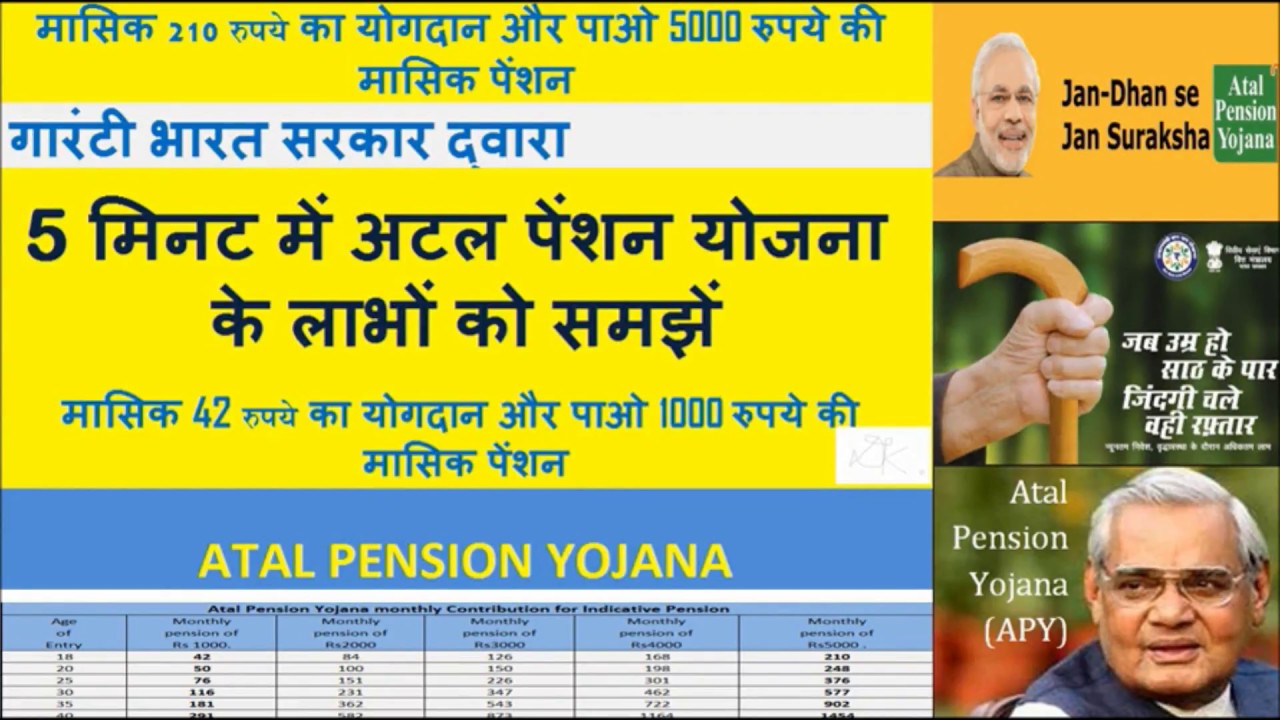

The APY would provide a set minimum monthly pension/income of Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000, Rs. 5000, at the age of 60 years depending on their contributions on the date of APY membership. The minimum contribution duration would be 20 years or more by any subscriber under APY. The policy would guarantee the value of a guaranteed minimum salary.

Eligibility for APY:

Individuals should be a citizen of India.

- Citizens should hold a valid bank account.

- People should have an age of 18 to 40 years.

APY Benefits:

Individuals can know the benefits of APY here:

- 80 CCD focuses on income tax deductions to avail of contributions made towards the APY scheme.

- Maximum Rs.1,000/- to Rs.5,000/- promised pension every month. The payout will also be greater if the actual return on pension contributions is larger.

- The insurance would apply to the partner if the recipient dies.

- The benefit fund would be allocated to the beneficiary in case of death of the recipient & partner.

Read More – SBI Fixed Deposit (FD)- Interest Rates Schemes, Features, and Plan 2019

Know-How to Apply for APY Pension Scheme:

Offline

- The APY scheme is offered by all nationalized banks. People can visit the banks to open an APY account.

- The application form is available in Telugu, Tamil, Odia, Marathi, Kannada, Gujarati and Bangladesh.

- Fill out and apply an application form on the website.

- The individual should ensure the correct mobile number at the branch.

- The person should also provide a photocopy of the Aadhaar card.

- The person shall obtain a confirmation message if the application form is accepted.

Online:

- Applications for opening accounts are also accessible on the bank’s websites. The application form can be accessed online for individuals.

- Existing account holders can choose the ‘Apply Now’ option in the portal.

- Submit OTP.

- Provide information on personal and nominee, pick the sum and duration of the pension.

- To confirm the enrollment, e-sign the application form.

Also, Check – Kotak Mahindra Bank Business Loan

Penalty Charges:

Of late contributions, an Rs.1 fine per month will be added to every Rs.100 contribution or half of the contribution, for each monthly contribution that is overdue.

- 1 per month on contributions of Rs.100/month

- 2 per month up to Rs.101-500 per month for contribution.

- 5 per month on contributions of Rs.501 to 1000/month.

- Of contributions above Rs.1001 a month, Rs.10 a month.

Withdrawal Process:

When the user reaches 60 years of age, he/she will retire from this plan with a full pension annuity.

Exit before 60 years of age is only allowed in exceptional circumstances, such as terminal disease or suicide. If the customer dies before 60 years of age, the recipient will be granted the benefit amount. The balance would be reimbursed to the applicant if both the client and the partner had expired.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.