The private sector Indian bank, Citibank has its headquarters in the city of Mumbai. Well, Citibank belongs to the Citi group and the bank is working as a subsidiary in India. Originally, Citibank was founded in the year 1802, and at that time it was started as Citibank of New York. Well, the bank is serving different banking needs related to financing for personal use, assessment management, and banking investments. Also, the bank is providing different loans like personal loans, car loans, and home loans. Check the Citibank Credit Card Status step by step guide below.

For making the credit card process simple and easy, the bank introduced a process that can be easy to understand for everyone. Not just every customer can get the best stuff but also they can enjoy the ownership of having a credit card. The process will take a shorter time for completing the whole thing. Those who want to own a credit card; they can now do that without worrying about anything. Not just for applying but for checking status, you just have to follow the basic steps.

Citibank Credit Card Application – An Easy Step by Step Guide:

Applying for a credit card in Citibank, there are simple procedures that you have to follow. The bank is covering categories like traveling and shopping which is highly important for today’s life. Well for applying there are two basic options that you get. But before you choose, make sure you know what exactly you are looking for as there are lots of types that the bank is offering to their customers.

- Apply via Online Method

Most of the bank now available the online option for applying for the credit card. You just have to visit the site and fill the form where information related to name, employment, overall income, and some basic documents are needed. You have to submit once you are confident about the application and wait for the reply from the bank

- Apply via the Offline Method

If you are not interested in the online option, then you can also go with an offline way. For that, find the nearest bank that you got, you will get the application from there. Make sure you fill in all information and attach the documents that are needed. After submitting, you have to wait until you get a response from the bank. However, it takes around 15 days for knowing the final results.

The bank will review your documents and application, not just that all information’s that you have mentioned will get verified for the next step. After your documents get verified you will get an SMS from Citibank or mail about confirming or acknowledging.

Types of Citibank Credit Card:

Citibank started in 1902 which also makes them the oldest market player who has more than 45 branches in different 28 cities. The bank is also playing the investor in the market of Indian finance. Citibank in India covers a grand range of credit cards, covering all needs and requirements of the people. Not just that, the credit cards cover basic all categories related to shopping, traveling and fuel as well as lifestyle, etc. The cards also designed in order to provide the best reward and benefits to their owner. That’s why it recommended that every person who wants to own a credit card, should check all information and what exactly the credit card is offering. Once your requirement gets matched, it will be easier for you to choose from.

1. Citi Rewards card

2. Citi Prestige credit cards

3. IndianOil Citi Platinum card

4. First Citizen Citi Credit Cards

5. Citi Premier Miles Credit Card

6. Citibank Rewards Domestic Card

7. IndianOil Citi titanium card

How to Check Citibank Credit Card Application Status Online?

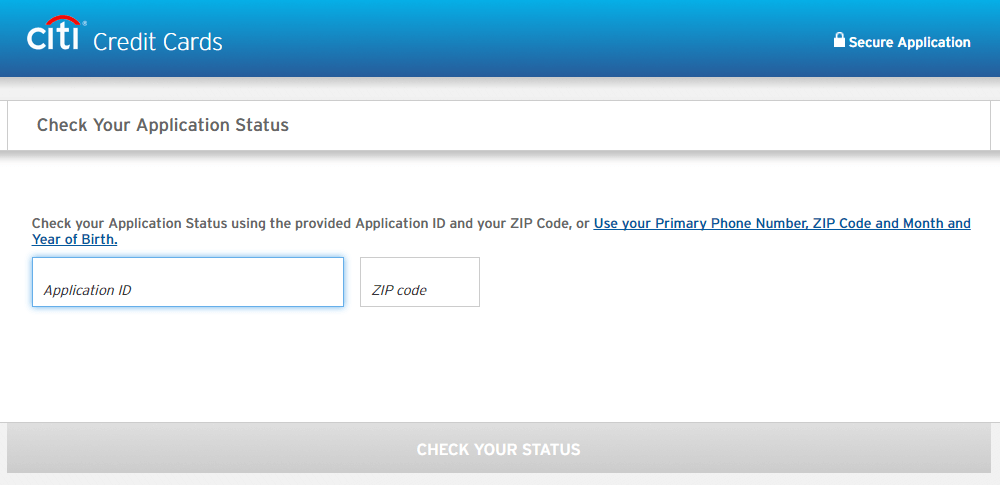

For checking the Citibank credit card status, there are several options that you are getting. However, you can choose the online option as well as offline, whatever fits you or makes you comfortable.

Also processing the credit card application in Citibank is easier and hassle-free, however, it’s crucial to remember some basic information that you should have with you.

A) How can your phone number help you?

Well, before this it’s important to know that your number can only help if is registered to the bank. Not just that only verified numbers are eligible for checking credit card application status. If your number is register and verified by the bank, here are the step that you need to understand

- Citibank has its website which is official for work like this. Also, the site is completely safe; you have to visit the site

- After you do that, there will be a section where you will find a section of credit card

- Once you open the section, there will be empty columns where your registration number is going to be needed.

- Your registration number will receive OTP for verification and for processing the further process

- After confirming, your application status will be shown on the site

B) How your airway number can help?

Your application for a credit card will process once your complete all basic and needed formalities. After checking, the bank will confirm the application as well as the credit card. Also, the applicant will get a letter from the bank, the letter consists of the information related to the Air Waybill number and other details. The shipment number can also help you in checking the status of your application.

- For checking the application, visits the bank’s website.

- Find the option Track your credit card and open it

- The page will redirect you to another one. Make sure that you have your airway number with yourself

- Enter the number to the given column

- After the number get verified, you can easily find the location and track your credit card

C) How can your birth date help you?

Well, Citibank also allows their customer to use their date of birth for checking the credit card status. You can download the app where you have to fill in the date of birth that you mentioned in the application. However, you can also use your phone number. If not app, then visit the website and find the track your credit card section. Just enter the verified date of birth and enter for the submission. You will get your status even if it’s dispatched, rejected, and approved.

How to Check CITI Bank Credit Card Application Status Offline?

We know that the internet makes it easier for people to check the application status online. However, not everyone is familiar with using internet services yet. Therefore, one can even check out the status of their applied credit card offline. Let’s have a look at the ways.

A) Citi Bank Customer Care

It is one of the easiest ways to know the status of your credit card application. You only need to call the toll-free number of Citi bank customer care 1860 210 2484.

Once the call gets connected, just provide some information along with the tracking number. The customer executive will tell you the status of your application.

B) Visiting the nearest branch

The second offline way to check the application status of Citi bank credit card is by visiting the nearest home branch. Just provide them your application tracking number, the executive will let you know the status of your credit card application.

Citibank Credit Card Login- Easy Steps:

For login, you are going to require your username and password. First, you have to visit the site where you have to register yourself. The whole process is completely free of cost. Once you get your username ID and password now you have to fill the login form. You can check whether you like, and for Citibank credit card login you can do it 24/7. Also, you will get your monthly bills, account statement, and everything in your mail every month.

Citibank Credit card Customer Care Number: If you have any questions or queries that you want to know about credit card application status then you can call on 18602102484 as the number is valid for 24/ 7 hours. Also, it’s the easiest option if you are no understanding the steps for the online process.

Here your call will be connected to the customer care of Citibank, make sure you keep the information and application number handy so it will not consume any time.

How to Make Citibank Credit Card Online Payment?

If your credit card is finally approved then you are also eligible for doing online credit card payments. There are the procedures that you have followed however the steps are easy and simple like other banks. Here are the options that you will get for doing your online payments:

- Net Banking: For paying through net banking, you have to visit the official site of the bank. Get the option for the credit card. You will get an option ‘credit card payment option’. After getting it, you have to choose the saving bank account option for processing the payment.

- ATM funds transfer: Well, there are lots of ATMs that you will find almost everywhere. You can use your credit card for paying the bills through ATMs. The services are always available no matter when you visit. Just follow the instruction that you get while doing the process. It is a hassle-free and easy way to do the payment as well.

- Autopay: These days people are busy and they don’t have time. Well no more as you can schedule your payments where your amount will be deducted on the fixed time given by you.

Frequently asked questions

Some questions related to CITI Bank Credit Card has been repeatedly asked to us. Therefore, we have decided to answer them all in one single place.

I have applied for a CITI Bank credit card online? When will I get my credit card?

Once the credit card application gets approved, it generally takes up to 21 days to dispatch the credit card to the customer’s postal address. However, if the time has passed then I prefer contacting the bank, though.

How to reactivate the closed CITI bank credit card?

You need to send a letter to the head office along with the self-attested copy of the pan card, aadhar card to reactivate your closed Citi bank credit card.

How long should I wait to reapply for my credit card application?

You need to wait for a minimum of three to six months before applying again for a credit card.

My credit card is rejected? What to do now?

If your credit card gets rejected from Citi bank then it means you were not eligible. You can increase your eligibility and apply again after three to six months.

How to apply for a CITI bank credit card?

You can apply for the Citi bank credit card online or by visiting the nearest home branch.

How to check the credit card application status of CITI bank credit card?

You can check the credit card application status of Citi bank credit card online or by calling customer service. Furthermore, one can go through the detailed guide we have added above in this article.

Conclusion:

Citibank is ruling over the banking sector and providing outstanding service to the people. Not just that, it covers most of the important categories so the people can enjoy their life without worrying. For that, you just have to apply for the credit card through the online or offline option. Once your application n got accepted, you can track it or check using your birth date, airway number, and even your phone number. But make sure that you only use the registration number.