Income Tax Calculator – Well, the income tax return is important but confusing for lots of people too. There are too many people who don’t know what to do first and what should be add in a taxable list or not. Also, there are things that can help you in saving the amount in your total tax but for that, You should be aware of what are those factors that can help. Apart from that, there is lots of calculation that are needed for getting the income tax and the correct amount for paying.

Well, for saving some amount of money there are different laws and claims that you can opt. For filing in the criteria, you must know your eligibility and which slot of income you are getting. Different slots have their own rules to follow. For saving themselves from the hassle there are lots of people go with the professional as they can handle the work much easier. Along with that, the documentation and what you need for what can also become much easier as simpler. This is a good option for those who are going for the first time filing for income tax return.

Why it’s important to understand everything? Well, it’s important because there are some incomes which are taxable whereas some are not. Also how you can do the calculation based on what and other lots of things that are needed for getting the amount for paying the tax.

If you are one of them and looking for a help which can solve the mess for you and also help you in understanding stuff much better. Then there is everything that you need to know, for making the basic clear, here are points to help.

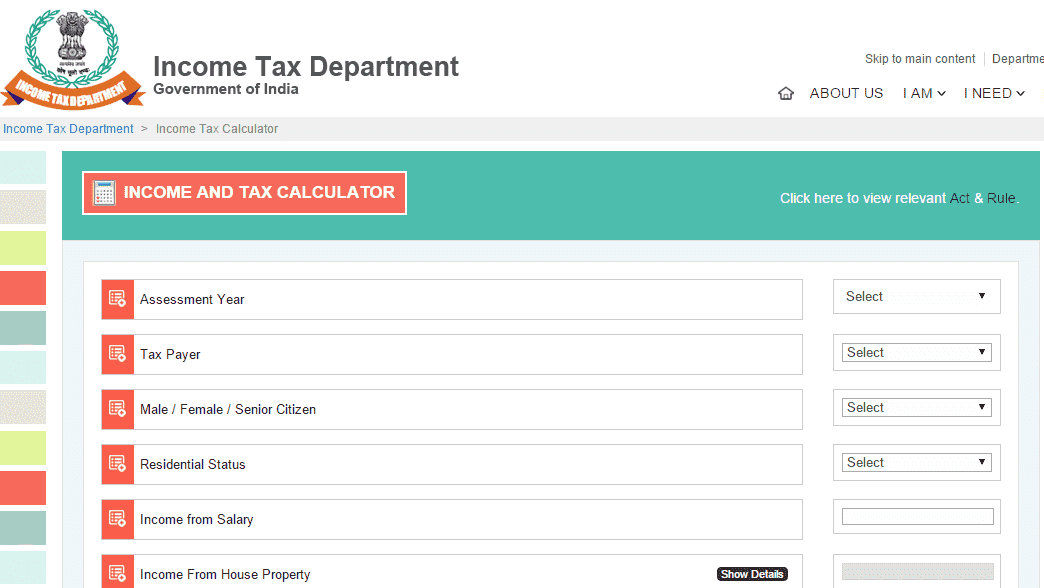

Income Tax Calculator Online Examples:

There are some basic steps that can help you in getting the correct calculation in income tax without facing any hassle. Well, the first thing that you have to do is tally all incomes from different sources that you have in one place. Also, check the taxable and nontaxable components that you have in your salary. Apart from that, there are a few more things that you should include such as:

- Your basic salary

- Your commissions and bonuses

- Allowances of yours

Also, there are a few points that can help you in knowing which allowance can be included in which part and how they can involve in the calculation:

- Fully taxable allowances: well the list includes DA (dearness allowance), OA (overtime allowances), and city compensatory allowance mostly given to the people who moved to the cities like Mumbai, Kolkata, Chennai, and Delhi.

- Partly taxable allowances: here you get allowances like HRA (house rent allowance), entertainment allowances and also other different kinds of special allowances

- Fully exempt allowances: the list of this category includes allowances for high court and judges of Supreme Court etc, apart from that it also includes foreign allowances for all those employees who are working or posted their job to another different country.

Well, there is a very basic formula that you can simply use for finding out the income tax amount for you. But before that, It’s important to have all informational, documents and correct data with you so whatever you figures get that will be accurate. This will help you in getting the right calculation as well. For the calculation of the amount, you can simply do the mathematics and use this formula for getting the final results

Here is what you can apply:

Your taxable income = Gross income of yours – (exemptions + deductions)

This will help you in getting the amount however for better and clear picture; you should go for the professionals.

How to Calculate Income Tax for the Salaried Person?

Income Tax Calculator for the salary person is one of the things where you have to be careful. Your carelessness can cost you more and you maybe end up paying the higher tax than you should. The taxation only exists with the relationship employer and employee. The very first that you need to know is the salary slab and on which point do your income fall. With that, you also have to declare your proposed investments so the further work can be done easily without facing too many difficulties in the calculation. However, for the calculation, there are a few things that you need to know.

1. Gross Salary:

For maximizing and saving tax around Rs 45000, you can invest the section 80 C for the Rs 150000. Here you can make the investments in other various things which includes provident fund, equity-linked savings, national savings etc. also you can deduct the amount which is eligible for the deduction, if you owe the house of yours then you are not eligible for claiming the home loan deduction interest in payment as well as the rent. Well for calculating the gross salary, here is what you can do

The calculation is,

Total of basic pay + Dearness allowances + transportation allowance + house rent allowance + special allowance + other allowance = the gross salary of yours

2. Deduct the Income from your Salary:

Deduction on income salary is mentioned under the section of 16 in the income tax act. Well the deduction includes:

- Tax on employment ( under section 16 (iii)): well the professional tax is eligible in the form of deduction while the incomes are from your salary

- Entertainment allowance (under section 16 (ii)): the allowance is given by the employer and the deduction is only allowed for that. Well, the deduction is just for those who are government employees. The deduction also can be the 1/5th part excluding the other benefits. However, the deduction is not for non-government employees.

Computation of Tax Liability:

After following the above points you will able to get the income tax however here are the steps that will help you in calculating tax liability. For doing that, here is what you have to follow:

- The first thing that you have to do total income round off and to closet 10 multiple

- The second thing that you have to do is a classification of the amount into long-term capitals, short-term capitals, lotteries etc.

- The computed tax will be added

- Levy surcharges to the balance you got

- Add cess of educational higher and secondary to the calculated income tax mount

- Rebates checking

- After closet, the multiple of 10, the amount that you will be got is the payable total tax.

How to Calculate Income Tax Include Income from all Sources?

When it comes to filing the ITR or income tax return, you have to use the ITR 1 where you have to fill different asked information divided into three heads which include income from salary or pension, income from other sources and the last one is income from house property. Well the most of the people feel consumed when it comes to filling the income from all sources as there you can fill just anything or they can be replaced with any other head. This includes the interest income, gifts, and other income details from various sources such as inheritance, lottery, family pension etc.

For understanding what you have to do for calculating and what you must know about these heads, here is the complete information that will help.

1. Bank’s Interest Income:

Most of the individuals have more than just one deposited in their bank which is divided into saving accounts, fixed deposits, and recurring deposits. However, the ITR work differently on these three forms. If the interest that you received it’s on the saving account then there is an option under the section 80 TTA where the maximum deduction will be Rs 10,000 or more than that in a year on the overall credited interest

However, not like the savings account, there is no such relief which is available for the interest or accrued fixed deposited which make both completely taxable. However, the rules are changed for the senior citizens.

2. Post Office Savings Scheme‘s Interest Income:

There are various investment options which include public provident fund (PPF), saving the account, time deposited and National saving certification. But the taxation of every option is different, not just that they all are taxable.

3. Other Investments and their Interest Income:

Excluding the bank and post office income interest income, there are different investments such as corporate bonds, corporate fixed deposits etc. however the taxation on all these investments completely depends on the nature of the investments.

4. Gifts:

Well, the gifts which come under the taxable will mention in HUFs. No matter it’s a monetary or if the not monetary item, it will include all movable and non-moveable property. Also, the tax will eligible if the total amount of the gift is more than Rs 50,000. Also, the tax is not applicable if the gift is in form of money which includes occasions like:

- It’s a fund, educational or medical institutions, etc

- It’s a wedding gift

- If it’s an inheritance or will

- If it’s from the donor who is dying

5. Not Declared Interest Under the Heads:

Other investments and the interest income which are not in your hand are also important to mention in the form of ITR, this will go under the head of exempted in paid taxes and the verification. However, do make sure that the amount will not exceed more than 10 lakh. If the amount exceeds then the tax will be at 10 percent.

What are the Changes in Income Tax Rules?

There are different changes that are going to happen soon in Income tax rules for making the system more reliable and beneficial for everyone. Well there are lots of differences that will make once these riles will come to the action but again there are needs that also should be fulfilled along with making the process simple for everyone. Here is the list of changes that will soon happen in the ITR rules:-

- The standard introduction of Rs 40,000

Well, the change will surely be going to help the salaried employees. After the introduction of this change, people who belong to salaried class can enjoy the deduction of RS 40,000 from the overall value of their income tax. However, the benefit of the change completely depends on the bracket of tax in which the individual came.

- Equity-based mutual funds tax dividend income

Well, a 10 percent rate of the tax will be divided and equally distributed by mutual funds which are equity oriented.

- Single insurance related to health policies tax benefits

Typically you get a discount if you are paying the premium before a year in the health insurance. But the individual can get the deduction amount more than Rs 25000 in an earlier time. After the change, the single premium health cases policies which have cover for more than just one year will also allow to proportionate base for the deduction. It also means that the deduction will be based on the year of the health insurance covered till now.

- Deduction on income interest for senior citizen

For a senior citizen, after the change happens they will get the high interest exempting in their income limit which is based on the deposits that have in bank accounts or post offices. Under the section 80TTA, there will be no deduction for the senior citizen.

- Limitation in deduction on TDS for senior citizen

Well, the threshold in the deduction of the tax proposed to get hiked as right now the amount is Rs10, 000 but it will turn to Rs 50,000.

- Specific diseases treatment tax deduction for senior citizen

For senior citizens, the deduction amounts on the health policies insurance premium are increased. The rules will change as those people who fall below 60 years will continue with Rs 25,000 according to the section 80 D. however if the parents of their whose age is more than 60 years, the individual can claim the deduction in an additional claim which will go Rs 50,000 and total deduction of Rs 75000.

Conclusion:

Income tax Calculator or calculation is one of the hassle-filled works if you are not aware of the terms and other important factors. Also, understanding the proper method and which income fall in which criteria is crucial. Well here wither you can hire a professional which is easier and recommended but if not then you can do it own as well. However whatever you choose, be sure that you are aware of every change that happened in the income tax return.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.