Introduction

A personal loan is an unsecured loan that may be taken in the case of an emergency, or for purposes such as education, home renovation, or big purchases. Personal loans require no collateral and are thus unsecured, and are typically for a short duration of one to five years. Repayment choices are adjustable and are determined by the lender on the basis of the credit history of the borrower. Repayments are made every month by EMIs by means of post-date cheques or asking the bank to use ECS (Electronic Clearing Services) to debit the EMI. Personal loans require less paperwork than other loans. There is no need for piles of photocopies or approved papers, so time invested in paperwork is minimized.

How to Get a Personal Loan without Documents

Financial institutions need to assess the ability of the consumer to repay when approving a loan. With a combination of factors, the credibility of the consumer is established and the lenders will accept the minimum documents needed for a personal loan.

Pay dues on time

It is imperative that EMI payments are made on time and there are no loan defaults. For example, for credit card users, the credit history must show that credit card dues were paid on time, particularly the total outstanding. It is crucial to preserve a good credit history, as it helps in conveniently availing the short term loan.

It is imperative that EMI payments are made on time and there are no loan defaults. For example, for credit card users, the credit history must show that credit card dues were paid on time, particularly the total outstanding. It is crucial to preserve a good credit history, as it helps in conveniently availing the short term loan.

If any payments due are missed, it indicates poor financial management. This would make it difficult to avail a personal loan without documents.

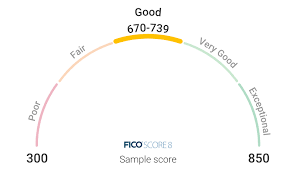

High credit scores

Credit scores are based on credit history: number of open accounts, total levels of debt, and repayment history, among other factors.

Credit scores are based on credit history: number of open accounts, total levels of debt, and repayment history, among other factors.

Maintaining a high credit score helps in establishing trust with the lender.

Good debt-to-income ratio

The debt-to – income ratio is a metric of personal finance that compares the amount of debt to total income.

The debt-to – income ratio is a metric of personal finance that compares the amount of debt to total income.

Lenders use it as a way to assess the ability of the borrower to repay dues.

A low debt-to-income ratio indicates high repayment capacity.

The Digital Way

After the demonetization, the word cashless transaction has taken center stage in the financial circle of India. The spillover effect has also been seen in personal finance where personal loan without documentation has emerged. Technology has made it possible for digital lending platforms to resolve conventional banking areas of concern and streamline procedures, such as personal loan documentation and approvals, and the time taken for disbursement.

The digital lending platform is designed to determine creditworthiness through an online review of personal and financial details. The entire process of personal lending through digital lending channels, right from application to disbursement, is quicker than conventional banks.

The system of a paperless personal loan becomes easier, since there is no need for heavy paperwork or regular bank visits. A personal loan can be availed with just a few taps. But avail a personal loan without documents through a digital lending platform, certain personal loan eligibility criteria need to be met.