Moving to a new country as an expatriate can be an exciting and challenging experience. Among the many things to consider, your credit score might not be at the top of your list, but it’s a crucial aspect of your financial life in the United Kingdom.

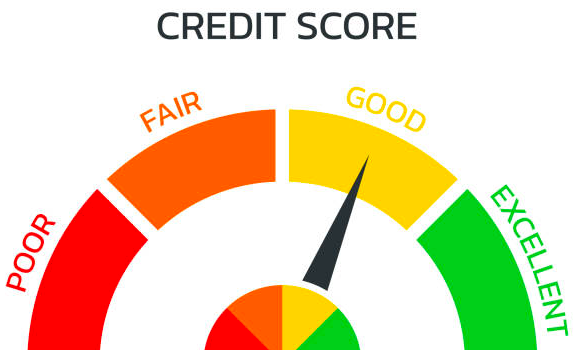

A good credit score can open doors to better financial opportunities, from securing a mortgage to obtaining a credit card. There are several ways expats can build their credit score while living in the UK and enjoy various financial benefits.

Understand the UK Credit System

Before diving into the intricacies of building your credit score, it’s essential to understand the UK’s credit system. The UK uses a different credit scoring system than many other countries, so familiarizing yourself with its nuances is vital. Credit reference agencies, such as Experian, Equifax, and TransUnion, compile your credit report and calculate your credit score based on your financial history in the UK. Your credit score typically ranges from 0 to 999, with higher scores indicating better creditworthiness.

Register on the Electoral Roll

One of the easiest and quickest ways to establish your creditworthiness in the UK is by registering on the electoral roll, also known as the electoral register or voter’s roll. This official list of eligible voters helps verify your identity and address, making it an essential component of your credit file. Lenders often check the electoral roll to confirm your residential address, which is crucial for many financial applications. Registering is simple and can be done online or by contacting your local council.

Open a UK Bank Account

A UK bank account is fundamental to building a credit history in the country. Start by opening a basic current account, which doesn’t require a credit history or a credit check. Over time, as you demonstrate responsible banking behaviour, you can upgrade to more advanced accounts and products, such as savings accounts, credit cards, and loans. Consistently managing your account, including paying bills on time and maintaining a positive balance, will help improve your creditworthiness.

Apply for a Credit Builder Card

A credit builder card is designed for individuals with limited or no credit history. These cards typically come with low credit limits and higher interest rates, but they can be an effective tool for building your credit score. Using a credit builder card responsibly, such as making timely payments and keeping your balances low, can demonstrate your creditworthiness to lenders and credit reference agencies. Over time, this can lead to better credit offers with more favourable terms. It may also make sense to download and use a credit builder app to track your improving credit.

Pay Bills on Time

Your payment history is one of the most significant factors influencing your credit score. Therefore, it’s crucial to pay all your bills, including rent, utilities, and credit card payments, on time. Late or missed payments can hurt your credit score and may remain on your credit report for up to six years. Setting up direct debits or standing orders for recurring bills can help ensure you never miss a payment.

Build a Credit History Gradually

While it’s tempting to apply for multiple credit products at once, it’s important to build your credit history gradually. Each time you apply for credit, a hard inquiry is made on your credit report, which can temporarily lower your score. Instead, focus on managing one or two credit accounts responsibly and wait until your credit score improves before seeking additional credit. Over time, responsible credit usage and timely payments will contribute positively to your credit history. There are also credit builder loans UK residents can apply for. These will also help you build your credit over time.

Monitor Your Credit Report Regularly

To track your progress and detect any errors or fraudulent activity, it’s essential to monitor your credit report regularly. You can obtain a free copy of your credit report from each of the three leading credit reference agencies annually. Review your report for accuracy and report any discrepancies or suspicious activity immediately. Monitoring your credit report allows you to control your creditworthiness and promptly address any issues.

Building a credit score as an expatriate living in the UK may require time and patience, but it’s a crucial step toward achieving your financial goals in your new home country. By understanding the UK credit system, registering on the electoral roll, opening a UK bank account, applying for a credit builder card, paying bills on time, building your credit history gradually, and monitoring your credit report regularly, you can establish and maintain a strong credit score that will serve you well in the UK’s financial landscape. Building good credit takes time, but with diligence and responsible financial management, you can unlock a world of financial opportunities in your new home.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.