Beginning investors often choose to invest in silver, especially silver bullion, because, like gold, it’s a safe haven asset but is not as expensive as gold.

A safe haven asset means an asset that tends to retain its value, or even increase in value, during tumultuous times, such as the 2008 financial crises and, more recently, the COVID-19 pandemic.

Both gold and silver bullion are priced per ounce. As of this writing, the price of gold per ounce is a staggering USD 1,796.00, while the price of silver per ounce is only USD 23.24.

That doesn’t necessarily mean that investing in silver bullion can’t pay off in the short as much as investing in gold bullion can. Instead, it means that investing in silver bullion can be a more affordable alternative for investors, especially those looking to hold for the long term.

Experienced investors diversify their portfolio with silver, particularly during economically unstable times, due to the consistency of its purchasing power. In fact, some studies show that when gold does not perform well as a safe haven asset, silver does.

Here are some of the things expert investors will tell you about investing in silver.

Invest in Silver by Purchasing Silver Bullion

Generally speaking, there are three ways to invest in silver:

- Invest in silver proxies, such as silver stocks or silver Exchange-Traded Funds (ETFs), which represent silver value

- Trade silver options and futures in the commodities market

- Invest in silver, the precious metal itself, e.g. silver bullion

Purchasing the precious metal itself in the form of silver bullion can be comparatively uncomplicated and affordable, experienced silver buyers might tell you.

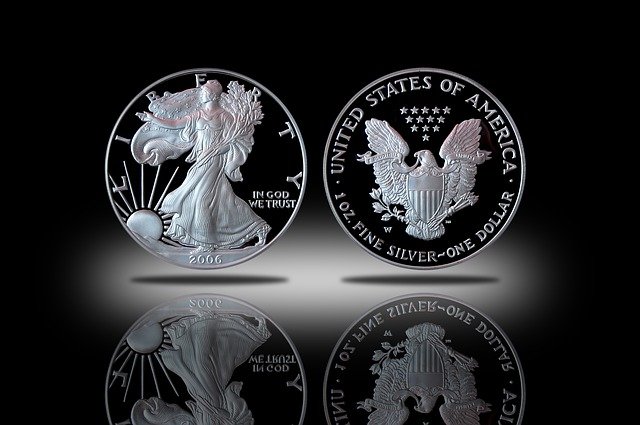

Silver bullion refers to 1oz silver bars, coins, and ingots that are officially recognized as being at least 99.9% purity and held as reserves by central banks.

Buy Silver Close to Spot Price, then Sell it at Spot Price

Expert investors will tell you that buying and selling silver bullion is a two-step process:

- Buy silver bullion as close to the spot price as possible, to minimize your premiums and maximize your eventual gains

- Sell silver bullion as close to the spot price as possible, and in rare scenarios, even above spot

Spot price means the price of any commodity at a particular moment. If, for example, you were to buy a commodity right now, its spot price would be the price of it right now. If you were to buy the same commodity two hours from now, the spot price of that commodity would be its price two hours from now.

Learning to think ahead in this way might help you get a good sense of the forecast for silver.

How to buy silver as close to spot price as possible

Experienced silver buyers might tell you to buy the right silver vehicle in bulk, perhaps by buying“junk silver coins,” and never buying silver bullion with more than a slight premium over spot.

A junk silver coin is any government-issued coin that contains silver that has none or only little collectible or numismatic value over the value of the silver metal itself that the coin contains. These days, the most popular junk silver are circulated US coins minted before 1965. However, since junk silver does not meet the purity level of 99.9%, these are taxable products and thus are not recommended for investment purposes.

The general rule of thumb is to try and purchase larger items, such as 10 troy oz, kilogram (32.15 troy oz) and 100 troy oz silver bars, as the premiums will be significantly cheaper than that of a 1 oz coin (a much higher premium item)

How to sell silver at spot price

Expert silver investors might tell you not to get duped or sold short and do your homework. Shop around online and in-person for bullion dealers with good reputations.

Also, research spot price, specifically on how silver bullion is spot priced, and wait until the time is right. Then contact bullion dealers with good reputations and ask whether they are willing to buy your silver as close to the spot price as possible.

Some bullion dealers are more willing to buy silver bullion at spot price or even slightly above spot price, if there are issues or challenges with supply chain at the time of sale. That’s another reason to do your homework.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.