A good and wick- witted employee would always look for smart investment policies. And intelligence lies when he or she learns to channelize the salary on the right path. Today our top pick is on how you should make your money be vested in the 401(K) plan. We will also provide insight on what it is exactly. In addition, the main highlight will be on the features and other information. Remember this plan is an integral addition to your savings schedule, as it will help you meet financial dilemmas during hours of need.

What is the 401(K) Plan?

Talking about a 401(K) Plan it dishonor a well-defined and systematic retirement- investment account offered to the employees. The plan got its name from the category of the internal- revenue code of the US. It is easy to maintain the account because the employees do not need to bother with the money deposit.

Read More – A Complete Review of Citibank – Going Digital

Note that the employees can automatically contribute the money from their payroll holdings to the 401(K) account.

Key Points to Remember:

- It is a company financed retirement based account.

- Employers have the right to make match oriented contributions.

- It is of two types Roth and traditional, they are different from each other in terms of taxation policy.

- In the case of traditional 401(k), the income tax is reduced depending on the contributions of the employees in a year. However, in that case, the tax is imposed on the withdrawals.

- Compared to that according to the Roth 401(k), tax is levied on the income. But the withdrawal is free of tax incumbents.

Features of the 401(K) Plan:

- Contribution of the employee:

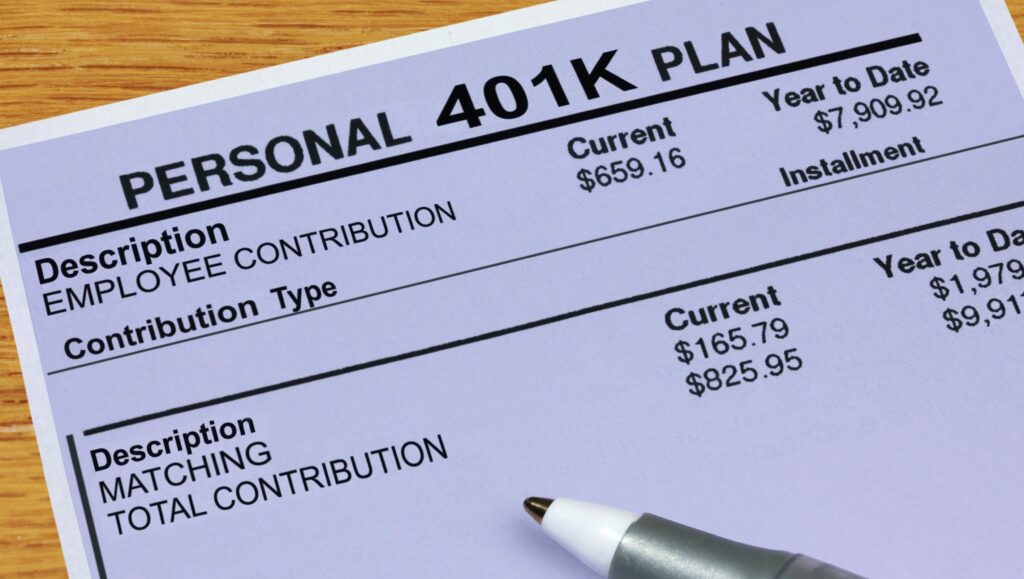

Highlighting on the contribution of the employee means it is the amount, which the employee willingly contributes to the 401(k) account. The best is that you can decide upon the percentage, which you want to contribute. Once you state the amount automatically gets cut off from the salary and gets transferred to the 401(k).

- Contribution of the employer and matching:

This means how much amount the employer is contributing to the 401(k) on behalf of the employee. Actually, some of the employers do directly contribute while some wait for the matching. That means employers match the employee contribution to a certain percentage. Now, this is followed to offer incentives to the employees, which will turn out to be a great financial boost during the retirement days.

In that regard, note that there are actually different kinds of matching. Like, for example, some will match dollar in return of a dollar while others will put percentages as a matching parameter.

- Varied options for investment:

When you talk about the investment options then do remember that it is great with the 401(k). Though it depends majorly on the employer, still 10 to 20 different options of investment are included in the different asset types. Most strikingly, it varies from the stock fund with low risk to stock funds with high risk. Additionally, there are money market funds as well.

Must Check – Top 7 Financial Investment Calculator Apps for Android

Guidance on Vestment and How to be Vested in it?

Vesting duration is a significant portion and is vital concerning employee contribution. Vesting refers to the process that means how faster the employer can transfer the authority of the contributions to the employee.

Some of the employers do follow the process of designating the contribution to the 401(k) account and that shows cent percent vested. Now, this becomes the ball game from the end of the employees.

That means once they get the ownership they instantly make up their mind of changing the job. Also, they get the privilege of transferring their money from the 401(k). In that case, they are the hundred percent owner of the money.

However, at times, the companies do follow the vesting process for a longer duration. This will make the employees do follow the graded vesting system. According to the graded process, a specific percentage of the amount is vested every year.

However, the other way round, it may take years to have a cent percent vestment. There are also cases where you will not get any kind of contribution from the employer to your account.

How to be Vested in it?

You will see that after a duration of 5 years of employment the employer-matching fund should be yours. But in the case of quitting your job after a period of 3 years, you will enjoy only 60% of the vested amount. That means you will have only 60% of the money that your employer contributed to the 401(k).

Final say:

The above article will guide you vividly on the 401(k) so that you can have it without any ambiguity.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.