Health insurance is a type of insurance that covers the cost of medical care. It helps to protect individuals and families from the financial burden of medical expenses. Health insurance plans typically cover doctor visits, hospital stays, prescription drugs, and other medical services. Depending on the plan, some health insurance plans may also cover preventive care, such as vaccinations and routine check-ups. Health insurance plans are typically offered through employers, but individuals can also purchase health insurance on their own. Health insurance helps to ensure that individuals and families have access to quality medical care when they need it.

Why is it necessary to have health insurance?

Having health insurance is essential for everyone. It provides financial protection in the event of an unexpected illness or injury, and helps to ensure that you can access the medical care you need.

Without health insurance, the cost of medical care can quickly become overwhelming. Even with insurance, medical bills can be expensive; however, they are usually much lower than they would be without insurance.

Health insurance also provides peace of mind. Knowing that you have coverage in case of an unexpected illness or injury can help reduce stress and worry. In addition to providing financial protection, health insurance can also help you access preventive care.

Regular checkups, vaccinations, and other preventive care services can

help you stay healthy and avoid serious illnesses. Without insurance coverage, these services may be too expensive to access on a regular basis.

In short, health insurance is essential for everyone. It provides financial protection and helps to ensure that you can access the medical care you need. It also helps to reduce stress and worry, and can help you access preventive care services. Having health insurance is an important part of staying healthy and protecting your financial security.

Click here to know why you should consider a health insurance plan for yourself and your family.

Different types of health insurance plans

Health insurance plans come in all shapes and sizes, so it’s important to understand the different types available and choose the plan that best fits your needs.

The most common type of health insurance plan is an employer-sponsored plan. This type of plan is offered by an employer and typically includes a network of providers, such as hospitals and doctors. These plans typically cover some of the most common medical expenses, such as doctor visits, prescription drugs, and preventive care.

Individual health insurance plans offer coverage just for one person or family. These plans are often more expensive than employer-sponsored plans, but they can provide more flexibility and choice in terms of the coverage they offer.

High Deductible Health Plans (HDHPs) are a type of health insurance plan that requires you to pay a high deductible before you can access your coverage. The advantage of these plans is that they usually have lower monthly premiums, but they come with higher out-of-pocket costs.

Finally, there’s short-term health insurance, which is designed to cover you for a short period of time—typically between one and 12 months. These plans provide basic coverage, often at a low premium, but they don’t typically cover the same services as an employer-sponsored or individual health plan.

No matter which type of health insurance plan you choose, it’s important to read the fine print and understand the coverage you’ll be getting. Doing so will help make sure you get the most out of your health insurance plan.

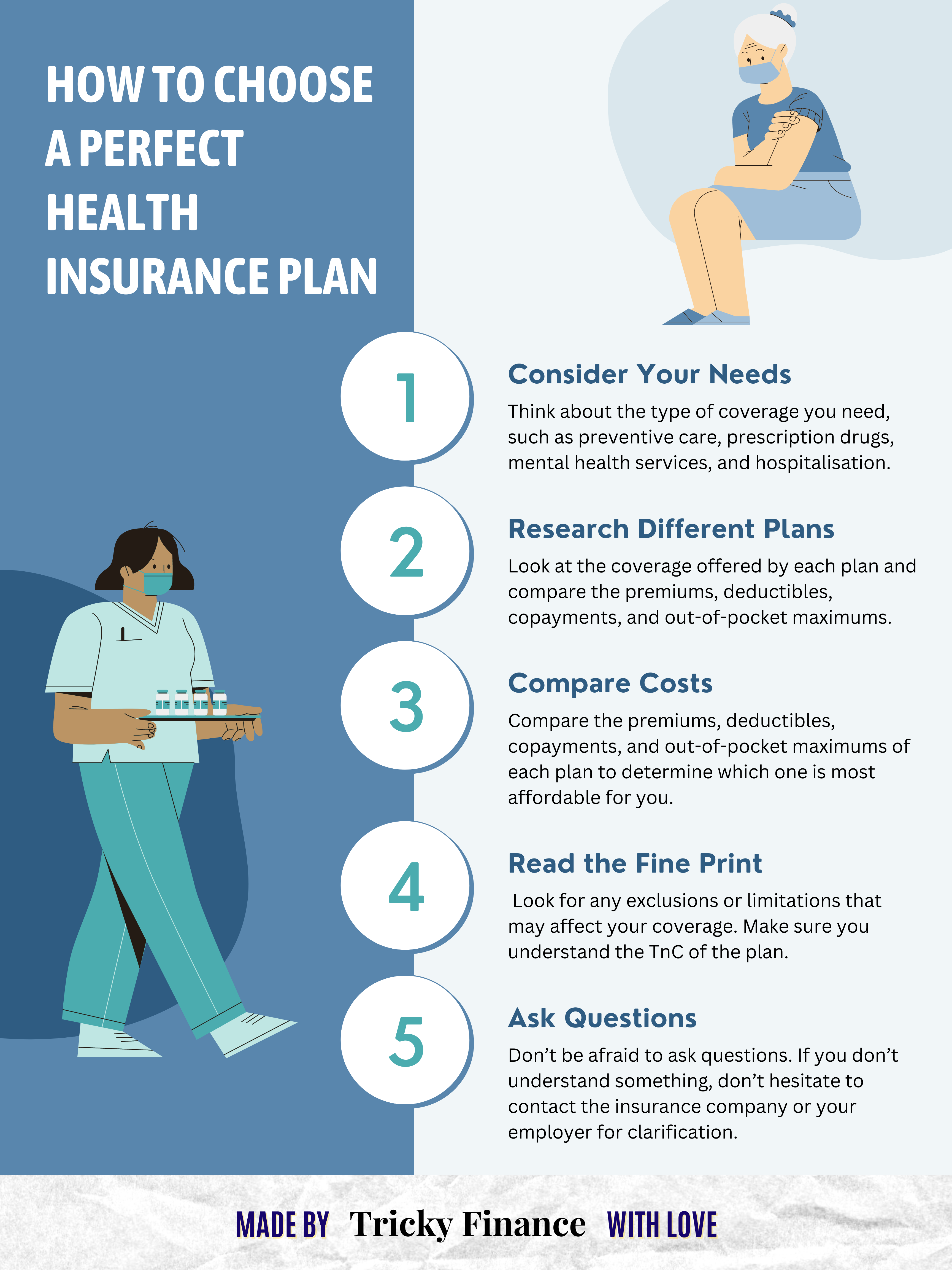

How to choose a perfect health insurance plan?

Choosing a good health insurance plan can be a daunting task. With so many options available, it can be difficult to know which plan is best for you and your family. Here are some tips to help you make an informed decision when selecting a health insurance plan.

1. Consider Your Needs: Before you start shopping for a health insurance plan, it’s important to consider your needs. Think about the type of coverage you need, such as preventive care, prescription drugs, mental health services, and hospitalisation. Also consider any pre-existing conditions you may have and whether or not you need coverage for them.

2. Research Different Plans: Once you’ve identified your needs, it’s time to start researching different plans. Look at the coverage offered by each plan and compare the premiums, deductibles, copayments, and out-of-pocket maximums. Also, consider the network of providers associated with each plan and make sure they include the doctors and hospitals you prefer.

3. Compare Costs: Cost is an important factor when selecting a health insurance plan. Compare the premiums, deductibles, copayments, and out-of-pocket maximums of each plan to determine which one is most affordable for you. Also, consider any additional costs such as co-insurance and co-payments.

4. Read the Fine Print: Before signing up for a health insurance plan, make sure you read the fine print. Look for any exclusions or limitations that may affect your coverage. Also, make sure you understand the terms and conditions of the plan, such as when coverage begins and ends, and what happens if you need to cancel the plan.

5. Ask Questions: Don’t be afraid to ask questions. If you don’t understand something, don’t hesitate to contact the insurance company or your employer for clarification.

By following these tips, you can make an informed decision when selecting a health insurance plan. Remember, it’s important to choose a plan that meets your needs and fits within your budget. With the right plan, you can ensure that you and your family have the coverage you need to stay healthy.

Click here to know about the different types of life insurance policies in India.

Hey! I am a content writer wiling to research, learn and write about something new everyday.