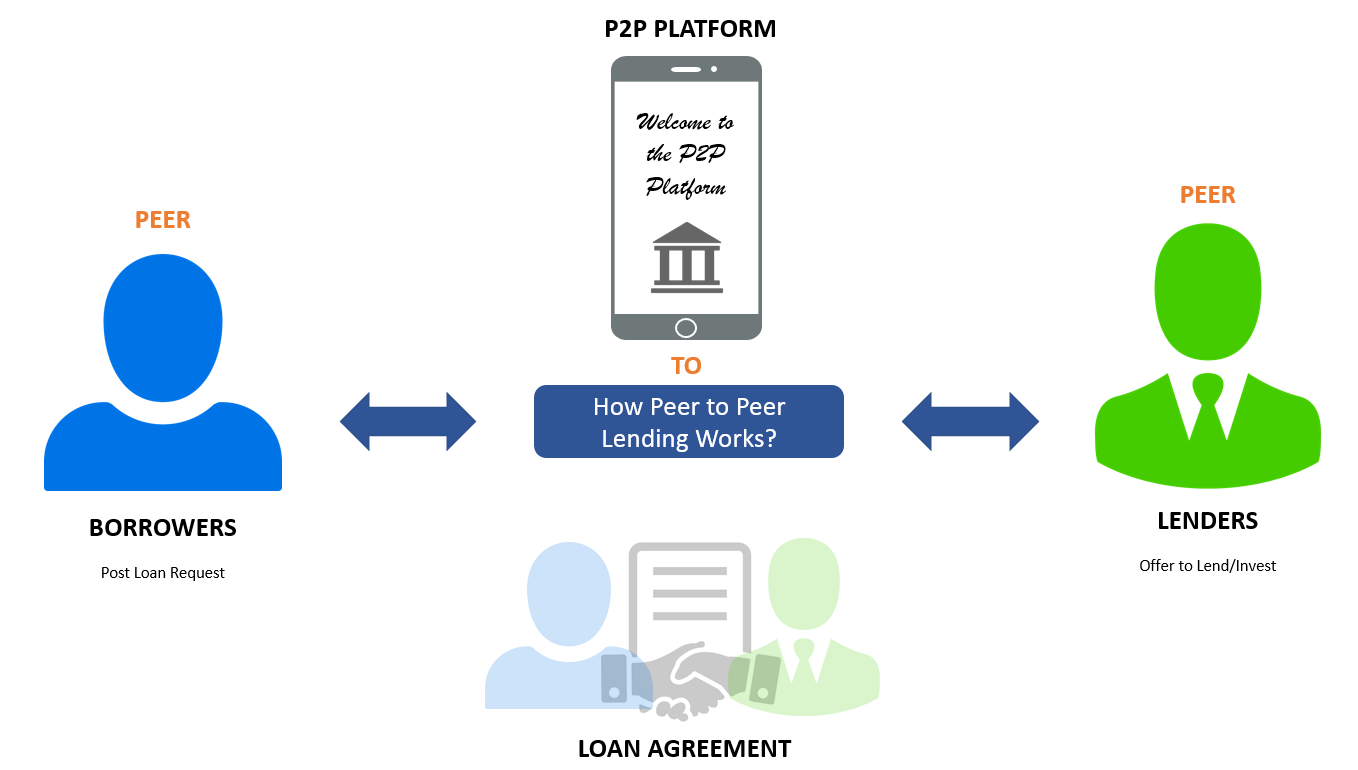

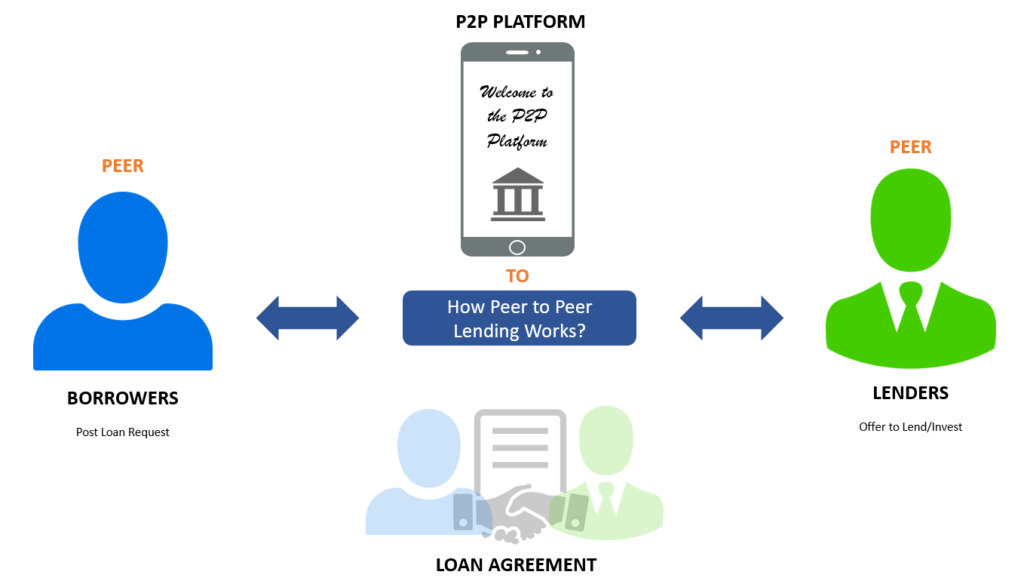

Peer-to-peer lending refers to the form of direct lending of money to businesses and individuals without the requirement of the official financial institution. There is no involvement of the financial institution for participating as an intermediary in the complete deal. The peer to peer lending is carried out with the help of an online platform that will match the landers with potential borrowers.

Value of the peer to peer lending

The peer-to-peer lending comes with both secured and unsecured loans. Most of the loans are unsecured secured loans available are quite rare for the industry and backed by the luxury goods. Peer to peer lending is considered as an alternative to financing due to its properties.

The P2P lending companies are much better when compared to the Savings and the banks. They necessarily do not behave in the form of the stock market like returns.

But in case you want more risk, then you can go further with the higher rates of interest. Some other options available are like payday loan borrowers, first-time property developers, and business startups.

P2P lending is getting around encouragement around due to the higher interest rates by lending money. It is a better option instead of putting the money in the Savings and getting the lower rates of interest.

Current situation of the P2P lending

Peer to peer lending in India is growing at around $ 5 billion industry by 2023. The original domain dates back to the year 2012. It was the year when the first peer-to-peer lending company i-Lend was launched.

The P2P lending space at present includes 30 players. Some of the noteworthy members among them are Faircent, IndiaMoneyMart, Monexo, LendBox, LenDenClub, LoanBaba, CapZest, Rupaiya Exchange, i2iFunding, and many more.

P2P lending has become successful in bringing down the cost of investment like never before. Funded borrowers pay interest rates between 12%-24%, based on risk profiles minus the hassles.

The current scenario holds numerous opportunities related to the peer to peer lending. The strong foothold you can see is in the financing sector. Demonetisation left banks strangled with hefty amounts of pending applications and loans.

Not every individual becomes part of the banking system. Some do not even have a regular income. Often, there are chances of losing track of the time before the required money arrives at your destination.

The NBFC and money lenders usually charge a rate of interest on personal loans. This phenomenon is driving borrowers away from local money lenders and NBFC. They are going ahead with the peer to peer lending portals. The high-interest rate from money lenders usually does not entertain them to borrow.

All we can say that is a peer to peer borrowing is growing due to its low-interest rates and convenient system.

Conclusion

Peer-to-peer lending usually comes with certain drawbacks like credit risk, unavailability of government protection, and legalization. At the same time, there are plenty of advantages that make it superior over the competitors. The high returns to the investors and a more accessible source of funding with low-interest rates usually encourage people to go ahead with peer-to-peer lending.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.