An abundance of different variables influences stock markets and the overall economy.

However, investors can understand and identify specific market trends and patterns through stock trading strategies for beginners.

What to know

Hong Kong stock prices are mainly dependent on the overall economic status of China.

The hub of modern capitalism, Hong Kong’s market, changes in major financial hubs such as New York or London.

Under normal circumstances, the banking sector dominates over other sectors in determining general growth trends.

Banking stocks tend to perform well during times when economic performance is positive; however, prolonged periods of low interest rates may reduce their relative influence over other sectors (particularly resources)

Surprise commodity discoveries and increased mining activity will likely boost other share prices such as those in iron ore, coal or other resource-related sectors.

A closely monitored economic indicator is the consumer price index (CPI), a critical determinant of inflationary pressures. Inflation discourages consumers from spending money due to fears that the purchasing power of their cash could drop over time.

If deflation occurs, it can be beneficial for overall economic growth by increasing personal disposable income.

Online Trading

Online trading has become increasingly popular in recent years, not only for experienced investors but also for beginners.

Hong Kong stock trading strategies may vary greatly depending on your level of exposure to markets and market volatility. While you may be tempted to invest large sums of money, it is generally recommended to start by learning the basics.

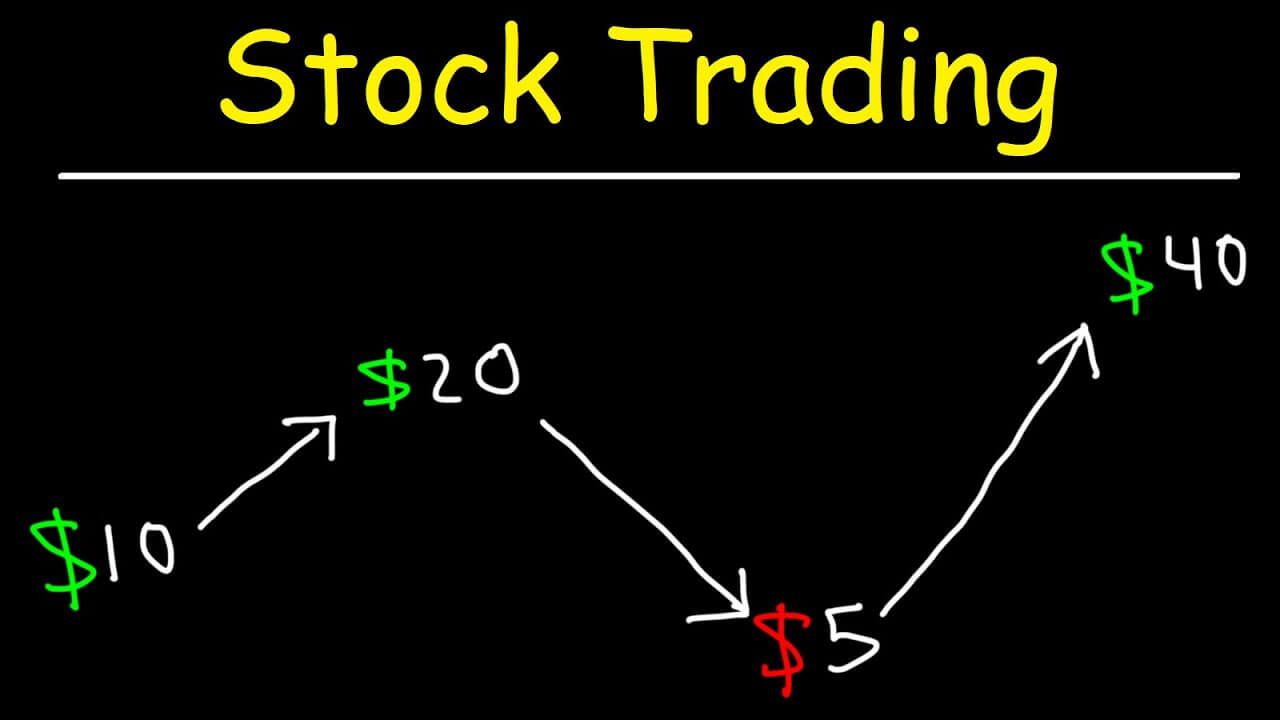

The stock market can fluctuate wildly in response to various economic factors and corporate activities such as mergers and acquisitions (M&A).

It has been known for smaller companies to experience significant share price increases when they announce a possible acquisition.

This may be due to the higher return on investment offered through acquiring rather than developing new business ventures or technologies.

On the other hand, larger firms may lose value if their share prices do not increase similarly.

Politics

Political risks can also create volatility in stock prices. When nations fail to balance the interests of different economic sectors, it may lead to disorganised development and capital outflows.

Global fears about nuclear war or high-profile terrorism linked to specific nations could trigger local sell-offs due to price drops in key sectors.

The Hong Kong market is home to several major international conglomerates, including mobile phone manufacturer Nokia (NOK) and Tencent Holdings (TCEHY), one of China’s largest technology companies.

These stocks are sometimes referred to as “blue chips” because of their relatively stable share prices under normal circumstances; larger firms tend to exhibit fewer erratic swings in share price than smaller companies.

Some common novice mistakes

A common novice mistake is to purchase shares immediately after a sharp fall in the market, hoping that prices will continue to improve. It can be an expensive and risky strategy if you fail to accurately assess why the market has suddenly changed course and what factors could influence movements in the future.

You may want to consider how relevant news or events that have recently occurred may influence future stock trends. Also, think about your investment timeframe; longer-term investing may reduce risk compared with short-term trades, requiring close market monitoring for quick returns on investments.

The fundamental principle for investing for beginners is to start small and learn as you go.

It can be daunting at first, but spending some time researching markets using historical data will help you form realistic expectations about future share performance.

Just remember that your aim should be to build wealth over many years rather than chase short-term gains that could quickly end in substantial losses!

Navigate to this website for more information

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.