We all do jobs so that we can meet ends meet and spend money on ourselves. Spending money involves spending on necessities, lifestyle and emergencies. However, if money is not spent wisely, it will consecutively lead you to have no money saved up for emergencies or future. For this, it is very important for individuals to be careful while spending money and also set aside a specific amount for saving. You can read more about spending less and saving more from here.

Many people have difficulty saving money and cannot stop themselves from impulsive buying. For this, the following are some of the tips which will help people to start saving up money and spending it carefully.

Cut down your expenses:

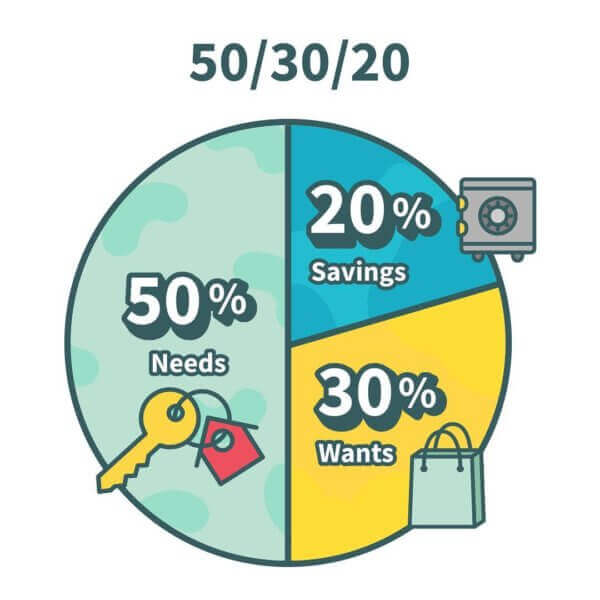

This is the first step of saving money. According to statistics, people should normally spend 50% on their daily necessities, 30% on luxuries and 20% on savings. However, if you want to save money for a big expense, such as a car or house, then these savings would not be enough.

In such scenarios, it is better to reduce the 50% to 40% on necessities and 30 to 20% on luxurious items. If you make a list of necessities that you buy every time you go for grocery shopping and reduce some items by buying things that you absolutely need, you will see that your spending budget has been reduced to half.

Cook at home:

For many people, buying ingredients and cooking at home might seem tiring, but if you are striving to save money, this is the best option. Eating out at restaurants might seem to be a utility, but it puts a strain on your everyday budget. Buying ingredients from the mart once a month and cooking at home is a healthy and wise alternative to going to restaurants.

If you eat out with friends and family weekly, you can reduce it to once every two weeks. After doing this for three to four months, you will see that your savings have become better and your eating lifestyle has also become healthier.

Use alternatives for entertainment:

Many people pay for monthly cable or get memberships in expensive clubs and gyms. These all are great modes of entertainment, but there are many places where you have fun with friends and family without spending excessive money.

You can plan an outing in the park, hiking, cycling or other outdoor spots for exercise. Cutting the cable bills will save you from hundreds of dollars and you can switch to less expensive subscriptions such as Netflix. You will also find many museums and art galleries which have no entry fees and you can enjoy art for as long as you want. Finding such alternatives will help you a lot in saving.

Pay your debts:

Having loans and debts are the worst enemies of savings. These loans might include house loans, car loans, student loans, etc. if you want to start saving successfully, the first thing you should do is to get rid of any debts that you have and start with a clean slate.

Paying debts and managing daily bills and necessities might be difficult to manage and put a strain on your lifestyle. For this, it is better for you to contact your financial advisor or some family member who is an expert in financial matters. You can make a financial plan which will help you deal with paying your debts. After you are done with them, you can start saving.

Cut down on using credit cards:

Just like debts, credit cards are also another expense that strain on your budget and stop you from saving properly. If you are spending continuously while using credit cards, you should definitely stop because it is just adding to your debts and list of bills that you have to pay.

If you are used to carrying cards, then it is better for you to switch to debit cards instead. You will only be able to spend as much as you have in your account and will also be able to keep check and balance. This will help you in saving money for the future.

Spend your savings wisely:

Buying the latest design that came out or going to the restaurant is not an emergency that would make you use your savings. Some people, even though separate money for savings, they cannot keep it for long. In such cases, savings should be saved from the savior.

There are many methods that can be used if you cannot keep your savings for long. You can open a separate bank account that you don’t normally use and keep all your money there. If you feel that transferring money is hectic, there are banks that offer services that automatically transfer a specific percentage of your salary every month.

Use discounts and offers:

Cutting back on expenses does not mean that you should not buy the things you like at all. It can also mean that you should try to buy the same things from alternative resources. Mostly these resources are cheaper and also offer discounts.

Using discounts, monthly or weekly offers and employee benefits from your job will definitely help you save a lot. Buying things in bulk from the supermarket sometimes also saves money.

Set goals:

Setting proper goals is very important for when you start saving. For this, you should fix the amount of money that you will save at the end of the year and should make proper financial plans so that you can achieve these goals. This will prove to be a very good motivation every month. However, you should be careful as to not make unrealistic goals that will demotivate you and stop you from making such plans in the future.

Controlling spending and saving from salary does not mean that you start living your life in misery or stop spending money at all. It just means living your life in a balanced way so that you do not have to depend on others when you have any emergencies.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.