It is a process of calculating the financial position of the company. The mathematical method of calculating a financial ratio that should be appearing in the financial statements of the company. It is to know the financial position and the performance of current to see the outlook of the future as well. Chek Types of Financial Ratio Analysis below.

Example: Net profit of financial ratio should be compared with the net income of per 100$ sales to check out the profits we earned per 100$ sale. Financial Ratio Analysis can be very beneficial because it simplifies the comparison of two or more business easily. It makes it easy for us to calculate and take an idea from the company by comparing both of them using financial ratio analysis.

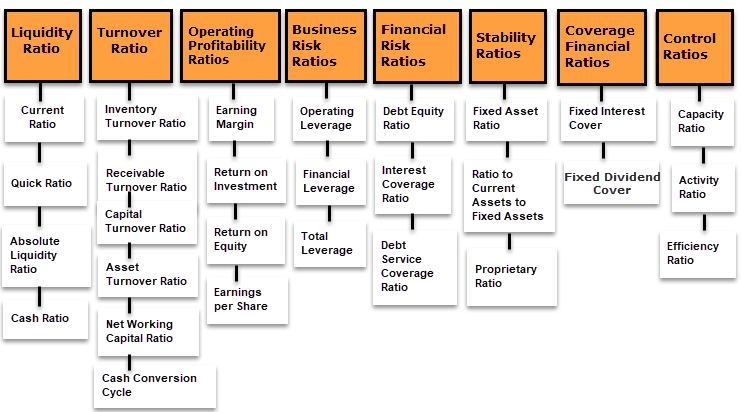

Types of Financial Ratio Analysis:

There are six main types of Financial Ratio Analysis, and the six ones are:

- Liquidity ratios

- Solvency ratios

- Profitability Ratios

- Activity Ratios

- Cash Flow Ratios

- Coverage Ratios

#1 Liquidity ratios:

It is a kind of asset uses for getting business liquidity. It can convert assets into cash to pay off any obligations without any difficulty. Suppliers, Bankers, and employers typically use it.

Essential Terms of Liquidity ratios are:

- Current ratio

- Quick ratio (also called acid-test rate)

- Cash ratio

- Cash conversion cycle

#2 Solvency ratios:

It used for getting the calculations of long term financial visibility of any business. It is often used to check out the ability of any company, whether it is capable of clearing their bank loans, bonds payable, etc. Information about the solvency of any business is essential for banks and their employers, and some of the vital solvency are:

- Debt ratio

- Debt to equity ratio

- Debt to capital ratio

- Times interest earned ratio

- Fixed-charge coverage ratio

- Equity multiplier

#3 Profitability Ratios:

The liquidity and solvency ratios used to explain the financial position of the company and on the other side for getting the ability of profit earned by business for their own is gets calculated by Profitability Ratio. Some of the Profitability ratio key impacts are:

- net profit margin

- gross profit margin

- operating profit margin

- return on assets

- return on capital employed

- return on equity

- earnings per share

Other ratios related to profitability that is used by investors to assess the stock market performance of business include:

- price to earnings (P/E) ratio

- price to book (P/B) ratio

- Dividend payout ratio

- Dividend yield ratio

- Retention ratio

#4 Activity Ratios:

This ratio often used for calculating the operating value of the company. Example: how they are converting their inventories into assets and how they are getting cash in returns of the asset.

Some of the critical activities ratios are:

- inventory turnover ratio

- days sales in inventory

- receivables turnover ratio

- days sales outstanding

- payables turnover ratio

- days payable outstanding

- fixed asset turnover ratio

- working capital turnover ratio

#5 Cash Flow Ratios:

To know the better financial position of the company. The actual earnings performance is required, for this cash flow ratio used to calculate the ongoing earning performance of the company, which often added in a statement annually.

#6 Coverage Ratios:

To measure the risk of the business, the coverage issues is a plus point intent to liquidity and solvency ratios. This is used to inherit the risk for the company in the long term.

Conclusion:

We know about the Financial statement of the company. The amount we earn or spend all added on the list. However, to calculate the financial position of any business, the financial ratio used, to collect the information we need, banks need, and our employees need.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.